Loading

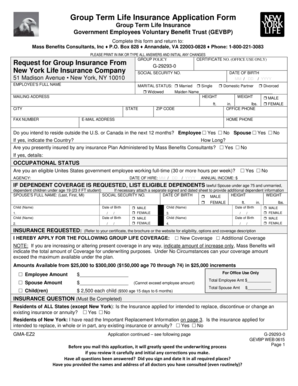

Get Group Term Life Insurance Nomination From

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Group Term Life Insurance Nomination Form online

Completing the Group Term Life Insurance Nomination Form online can seem daunting, but this guide aims to simplify the process. Here, you will find clear, step-by-step instructions to help you fill out the necessary information accurately and confidently.

Follow the steps to successfully complete the Group Term Life Insurance Nomination Form

- Press the 'Get Form' button to access the nomination form and open it in your preferred document editor.

- Begin by entering your personal information in the designated fields. This includes your full name, social security number, date of birth, marital status, height, and weight. Ensure that all entries are accurate.

- Provide your mailing address, including city, state, and ZIP code. Also, include your office and home phone numbers, as well as your email address.

- Indicate whether you intend to reside outside the U.S. or Canada in the next 12 months by checking the appropriate box. If yes, specify the country.

- Confirm your employment status by stating if you are an eligible government employee working full-time. Also, provide your agency name and date of hire.

- If you are applying for dependent coverage, list all eligible dependents, including your lawful partner and dependent children, along with their details (full name, social security number, date of birth, height, and weight).

- Select the insurance coverage you wish to apply for and note the desired amounts. Ensure that you adhere to the coverage limits specified in the form.

- Answer the insurance questions regarding medical history honestly. If necessary, attach additional sheets for explanations.

- Designate your beneficiaries by providing their names, relationship to you, social security numbers, and address. Make sure to note the percentage of benefits each beneficiary will receive.

- Review your completed form for accuracy. Make any necessary corrections and initial any changes.

- Sign and date the form where indicated. If your partner is also applying for coverage, ensure they sign as well.

- Once all fields are completed, save your changes. You can then download, print, or share the form as needed before mailing it to the designated address.

Complete your Group Term Life Insurance Nomination Form online now to ensure your coverage is in place.

But if you fear you might not qualify for a good rate as an individual, perhaps due to a medical condition, group life insurance through your work is a good idea. Just remember the limitations, especially if you don't expect to stay at the employer for a long time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.