Loading

Get Quarterly Transient Occupancy Tax Return For Delinquent Taxes - Kcttc Co Kern Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Quarterly Transient Occupancy Tax Return For Delinquent Taxes - Kcttc Co Kern Ca online

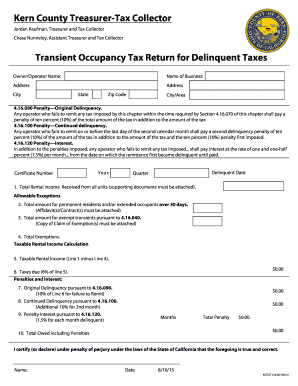

This guide provides step-by-step instructions for successfully completing the Quarterly Transient Occupancy Tax Return for Delinquent Taxes for Kern County. It is designed to help users understand each section of the form and fill it out accurately online.

Follow the steps to complete your tax return form easily.

- Press the ‘Get Form’ button to obtain the form and open it in your document editor.

- Fill in the Owner/Operator Name field with the name of the individual or business responsible for the rental.

- Enter the Name of Business, if applicable, as it relates to the rental operation.

- Provide the business Address, including street name and number.

- Fill in the City and State fields corresponding to the business address.

- Complete the Zip Code field to ensure accurate location identification.

- Indicate the City/Area where the rental properties are located.

- Input the Certificate Number that corresponds to the tax identification.

- List the Year for which you are declaring the taxes.

- Provide the Delinquent Date and the specific Quarter being reported.

- Calculate the Total Rental Income Received from all units and ensure to attach supporting documents as required.

- Enter the total amount for permanent residents and/or extended occupants over 30 days, attaching Affidavit(s)/Contract(s) as necessary.

- Fill in the total amount for exempt transients according to the provided guidelines, ensuring a copy of Claim of Exemption(s) is attached.

- Aggregate the Total Exemptions to account for any reductions in taxable income.

- Calculate the Taxable Rental Income by subtracting Line 4 (Total Exemptions) from Line 1 (Total Rental Income).

- Calculate the Taxes Due by applying the 6% tax rate to Line 5 (Taxable Rental Income).

- Determine the original delinquency penalty (10% of Line 6) if applicable.

- Calculate the continued delinquency penalty (additional 10% for the second month) if applicable.

- Calculate the penalty interest (1.5% for each month delinquent) if applicable.

- Sum the total penalties and the total owed, including penalties.

- Sign the certification statement, providing your name and the date of filing.

- Finally, save your changes, download the completed form, and print it for your records.

Complete your tax return online today to ensure compliance and avoid penalties.

Related links form

Transient occupancy is an additional source of non-property tax revenue to local government. This tax is levied in Kern County at a rate of 6% for accommodations at lodging facilities in the unincorporated areas of Kern County.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.