Loading

Get Memorandum Of Decision Granting The Debtors'' Motions To Avoid Judicial Lien

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

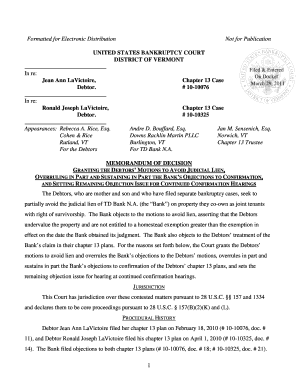

How to fill out the memorandum of decision granting the debtors' motions to avoid judicial lien online

Filling out the memorandum of decision granting the debtors' motions to avoid judicial lien online can be a straightforward process with the right guidance. This guide provides step-by-step instructions tailored to users regardless of their legal experience.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the memorandum of decision form and open it in your preferred online editing tool.

- Begin by entering the names of the debtors at the top of the form. These should be the full legal names as they appear in the bankruptcy filings.

- Specify the chapter number of the bankruptcy case, typically 'Chapter 13', in the designated field.

- Fill in the case number for each debtor’s bankruptcy file. Ensure accuracy to avoid any processing issues.

- Input the date of filing and the current date in the appropriate sections. This information is crucial as it affects the timeline of the case.

- Detail the appearances of all legal counsel involved in the case, including their names and law firms, in the sections provided.

- Summarize the key details of the case including the motions to avoid liens as requested by the debtors and the objections raised by the bank.

- Review any findings of fact that apply in your case and ensure they are accurately reflected in the document.

- Provide the court’s decision regarding the motions and any further actions required, noting any objections that were sustained or overruled.

- Finalize the document by ensuring all sections are thoroughly completed and accurate, then save your changes.

- Download, print, or share the completed form as needed. Ensure a copy is available for your records.

Complete your memorandum of decision online today to expedite your case.

Once you've completed your Chapter 13 repayment plan, most remaining nonpriority unsecured debt balances will get discharged. Student loan balances are a notable exception—you'll remain responsible for those (at least for the present). Student loans fall into the category of nonpriority unsecured debts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.