Loading

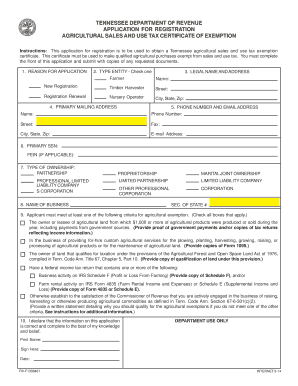

Get Application For Registration Agricultural Sales And Use Tax Certificate Of Exemption. Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Registration Agricultural Sales And Use Tax Certificate Of Exemption online

This guide will provide you with clear, step-by-step instructions on how to effectively fill out the Application for Registration Agricultural Sales and Use Tax Certificate of Exemption online. By following these directions, you will be well-prepared to navigate the application process with confidence.

Follow the steps to fill out the application correctly.

- Press the ‘Get Form’ button to access the application form and open it in your document editor.

- Indicate the reason for your application by selecting either 'New Registration' or 'Registration Renewal'.

- Select your entity type. You can choose from options such as 'Farmer', 'Timber Harvester', or 'Nursery Operator'.

- Provide your legal name and address. Enter the name as it appears on legal documents and include the complete mailing address.

- Fill in your primary mailing address if it differs from your legal address.

- Enter your phone number and email address for any correspondence related to the application.

- Input your Social Security Number or Federal Employer Identification Number (FEIN) if applicable.

- Select the type of ownership that best describes your business from the provided options.

- Enter the name of your business if it’s not a sole proprietorship and include the Secretary of State number if applicable.

- Review the criteria for eligibility for the agricultural exemption and check all applicable boxes based on your qualifications.

- If you do not meet the standard criteria, provide a written statement elaborating why you believe you qualify.

- Sign the application by providing your printed name, signature, and the date of submission.

- After ensuring all fields are completed correctly, save your form. You can choose to download, print, or share the completed application as needed.

Start filling out your Application for Registration Agricultural Sales and Use Tax Certificate of Exemption online today!

Most organizations and individuals will accept the governmental information letter as the substantiation they need. You can request a governmental information letter by calling the Internal Revenue Service Tax Exempt Government Entity line at 1-877-829-5500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.