Loading

Get 2525pp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2525pp online

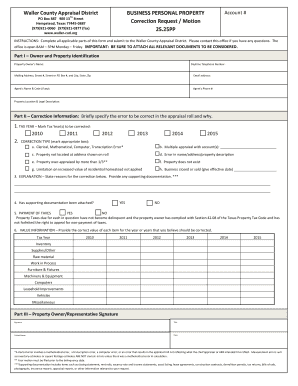

The 2525pp form is essential for submitting correction requests for personal property appraisals in Waller County. This guide provides a clear, step-by-step process to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the 2525pp online.

- Use the ‘Get Form’ button to access the 2525pp and open it for completion.

- In Part I, provide your contact information as the property owner. Include your name, daytime telephone number, mailing address (including street number, street name, city, state, and zip code), email address, agent's name and code (if applicable), agent's phone number, and the property location and legal description.

- Move to Part II to specify the correction information. Clearly state the appraisal roll error you wish to correct and the reasons for it. Mark the tax year(s) that need correcting by checking the appropriate boxes.

- In this section, select the type of correction by marking the relevant box, such as clerical, mathematical, or transcription error. Provide further details in the explanation section and include supporting documentation as necessary.

- Indicate whether supporting documentation has been attached, ensuring to check ‘Yes’ or ‘No’. Supporting documents may include bills of sale, tax returns, or photographic evidence.

- Confirm that all property taxes due for the contested years are not delinquent. This is required for your right to appeal.

- Provide the corrected value for each item in the specified years, including inventory, supplies, raw materials, and equipment.

- Complete Part III by signing the form. Ensure you print your name, include your title if applicable, and date the form.

- Finally, save your changes, then proceed to download, print, or share the completed form as needed.

Take the time to complete the 2525pp online and ensure your appraisal corrections are submitted promptly.

Related links form

If you do not have a deed in your name or other recorded instrument documenting your ownership, you can still qualify for an exemption by completing a simple affidavit in the homestead exemption application form, which is available in Form 50-114-A on the Texas Comptroller's website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.