Loading

Get The Difference Between Tax Avoidance And Tax Evasion Worksheet

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out The Difference Between Tax Avoidance And Tax Evasion Worksheet online

Filling out The Difference Between Tax Avoidance And Tax Evasion Worksheet online is an important step in understanding your responsibilities as a taxpayer. This guide will walk you through each component, providing clear and supportive instructions.

Follow the steps to complete the worksheet effectively.

- Click the ‘Get Form’ button to access the worksheet and display it in your form editor.

- Begin by entering your name and the current date at the top of the form. This identifies your document.

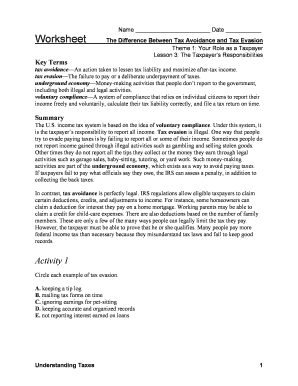

- Review the key terms provided in the worksheet. Understand the definitions of tax avoidance, tax evasion, the underground economy, and voluntary compliance, as they are critical to the completion of the form.

- Proceed to Activity 1. Circle each example that illustrates tax evasion from the list given. This exercise reinforces your understanding of what constitutes illegal tax activity.

- Move on to Activity 2. Read the provided scenario about Dave and Marie, and write your analysis in the space provided. Here, you will distinguish between tax evasion and tax avoidance.

- In Activity 3, read through the example concerning tips earned at a restaurant. Compose a persuasive letter to explain to your friend why reporting tips is essential. This will allow you to reflect on the information in a practical context.

- After completing all activities, review your answers to ensure accuracy. Make any necessary revisions.

- Finally, save your changes, and download, print, or share the completed worksheet as needed.

Complete the worksheet online today to enhance your understanding of tax responsibilities.

When an individual or business intentionally doesn't comply with Canada's tax laws with actions such as falsifying records and claims, hiding income, or inflating expenses, it's tax evasion. Aggressive tax avoidance, on the other hand, occurs when actions are taken to get around the intent of the law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.