Loading

Get Nr302

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NR302 online

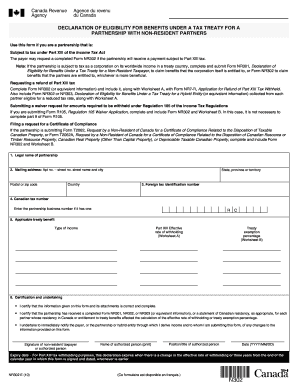

The NR302 Form is essential for partnerships with non-resident partners to claim benefits under a tax treaty. This guide provides a clear and supportive approach to understanding and filling out the NR302 online, ensuring you meet your tax obligations efficiently.

Follow the steps to complete the NR302 form effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Provide the legal name of the partnership in the designated field.

- Enter the mailing address, including apartment number, street number, the street name, city, postal or zip code, country, and state, province, or territory.

- Fill in the foreign tax identification number, if applicable, followed by the Canadian tax number if the partnership has one.

- Indicate the applicable treaty benefit by specifying the type of income, along with the effective rate of withholding from Worksheet A and the treaty exemption percentage from Worksheet B.

- In the certification section, confirm that all information provided is correct and complete. Include your signature, print your name, and state your position or title along with the date.

- Once all fields are completed, review your form for accuracy before saving changes. You can then download, print, or share the form as necessary.

Start completing the NR302 form online to ensure your partnership benefits from the appropriate tax treaty.

On Form NR303, there is a box to indicate a corporation or a trust. A hybrid entity can be considered either a corporation or a trust for Canadian tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.