Loading

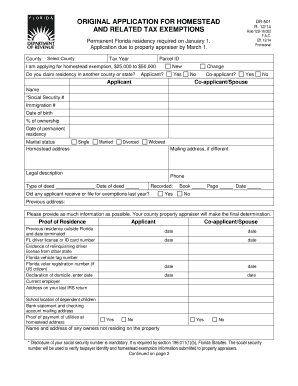

Get Form Dr-501 - Original Application For Homestead And Related Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DR-501 - Original Application For Homestead And Related Tax Exemptions online

The Form DR-501 is essential for individuals seeking homestead exemption and related tax benefits in Florida. This guide will provide you with user-friendly, step-by-step instructions on how to successfully complete the form online, ensuring you understand each section and requirement.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by selecting your county and entering the tax year for which you are applying. Fill in your Parcel ID to identify your property accurately.

- Indicate whether you are applying for a homestead exemption and specify the exemption amount you are applying for, starting from $25,000 to $50,000.

- Answer the residency question to disclose if you claim residency in another county or state by selecting 'Yes' or 'No.'

- Please provide the applicant's and co-applicant's (if applicable) information such as names, Social Security numbers, immigration numbers, dates of birth, percentage of ownership, and dates of permanent residency.

- Choose the marital status of the applicant and provide the homestead address along with a different mailing address if necessary.

- Provide the legal description of your property and type of deed, as well as the phone number and date of the deed.

- Indicate if any applicant has received or filed for exemptions last year, and fill in the previous address if applicable.

- You must provide proofs of residence, residency outside Florida, and evidence for any requested exemptions, which may include documentation for driver licenses, vehicle tags, and voter registration.

- Once all sections are completed, review the form for accuracy. You will then be able to save changes, download, print, or share the form as needed.

Start completing your Form DR-501 online today to ensure you obtain your homestead exemption.

You may file for your homestead exemption by mail, in person or on-line at www.leepa.org. If filing online, please read on-line filing instructions carefully to determine eligibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.