Loading

Get Motor Oil Fee Return For Periods Beginning 712009 And After Motor Oil Fee Return For Periods

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Motor Oil Fee Return For Periods Beginning 7/1/2009 And After online

Filling out the Motor Oil Fee Return online is a straightforward process designed to comply with the Tennessee Department of Revenue requirements. This guide provides clear instructions to help you effectively complete the form and ensure timely submission.

Follow the steps to complete your Motor Oil Fee Return online.

- Click ‘Get Form’ button to access the Motor Oil Fee Return document and open it in the online editing platform.

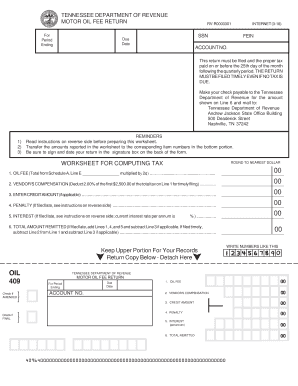

- Begin by entering your account number or, if not preprinted, your federal employer identification number (FEIN) or social security number (SSN). This information must be accurately provided to identify your account with the Tennessee Department of Revenue.

- Indicate the period ending date for which you are filing the return. This is essential for determining the correct tax period.

- Fill in the details regarding the oil fee calculated in Schedule A. Transfer the total number of quarts subject to the fee that you computed to Line 1 of the form. Multiply this number by 2 cents to obtain the oil fee.

- If applicable, calculate and enter the vendor's compensation on Line 2. Deduct 2% of the first $2,500 of the total from Line 1 if you are filing your return timely.

- Complete Line 3 with any credit amount you may have from previous notifications by the Department of Revenue.

- If your return is filed late, refer to the reverse side instructions to calculate the penalty on Line 4 and interest on Line 5. Ensure to record these amounts accurately.

- For Line 6, calculate the total amount remitted. If late, sum Lines 1, 4, and 5, and subtract Line 3. If timely, subtract Line 2 and Line 3 from Line 1.

- Ensure you sign and date your return in the designated signature box. If a paid preparer is used, they must also sign the return.

- Finally, review your form for accuracy. Once satisfied, save your changes. You can then download, print, or share the completed return as necessary.

Complete your Motor Oil Fee Return online today for smooth processing and compliance with Tennessee regulations.

Tire Environmental Fee - $5 for a motor vehicle with four or fewer wheels, not including any spare; $10 for a motor vehicle with more than four but fewer than 11 wheels, not including any spare; $15 for a motor vehicle with 11 or more wheels, not including any spare.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.