Loading

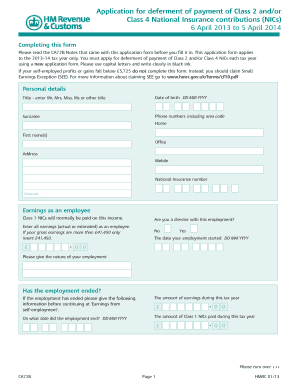

Get Ca72b - Application For Deferment Of Payment Of Class 2 And/or Class 4 Nics. Application For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA72B - Application For Deferment Of Payment Of Class 2 And/or Class 4 NICs online

Filling out the CA72B form is a straightforward process that allows users to apply for the deferment of payment for Class 2 and/or Class 4 National Insurance contributions. This guide provides detailed instructions to help users complete the form effectively and confidently.

Follow the steps to complete your application successfully.

- Click the ‘Get Form’ button to access the application form and open it for editing.

- Begin by reviewing the instructions and supplementary notes provided with the form to ensure you understand the requirements. Pay particular attention to the eligibility criteria related to your earnings.

- Fill in your personal details accurately. This includes your title, date of birth, surname, first name(s), and contact numbers. Make sure to include your National Insurance number and postcode.

- Provide details about your earnings as an employee. Indicate if you are a director and record your earnings, ensuring that if your gross earnings exceed £41,450, you only enter £41,450.

- If your employment has ended, include the date of termination and specify your total earnings and any Class 1 National Insurance contributions paid during this tax year.

- Proceed to the section for earnings from self-employment. Enter your Self Assessment tax reference number and the nature of your self-employment. Again, if your gross earnings exceed £41,450, only record that amount.

- Complete the declaration, confirming your consent for HM Revenue & Customs to deal with a third party if applicable. Ensure you attach the necessary consent if required.

- Sign and date the declaration to validate your application. Be mindful that this is a legal document, and your signature indicates your understanding of the obligations outlined.

- Once you have completed the form, you can save your changes, download the form for your records, and print it if necessary. Finally, send the completed form to the specified address for HM Revenue & Customs.

Complete your CA72B application online today and ensure timely deferment of your National Insurance contributions.

Class 2 NIC can be paid voluntarily through self assessment by completing the self employment section of the return. If you have no income then this will not be calculated but if you tick the box to pay voluntarily and then the recalculate button, this should generate the relevant class 2 amount on your calculation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.