Loading

Get Senior Property Tax Releaf Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Senior Property Tax Releaf Form online

This guide provides a comprehensive overview of how to complete the Senior Property Tax Releaf Form online. It is designed to assist users in navigating each section smoothly and ensuring all necessary information is included.

Follow the steps to complete your application effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

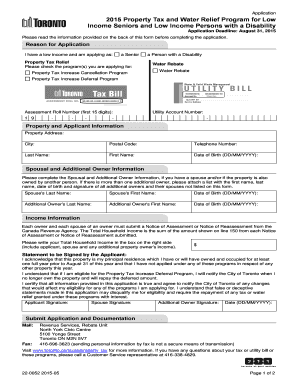

- Identify your reason for application by selecting whether you are a Senior, a Person with a Disability, or applying for a Water Rebate. Check the appropriate program boxes.

- Enter your Assessment Roll Number, which is a unique 15-digit identifier for your property, followed by your Utility Account Number.

- Fill in your Property Address, City, Postal Code, and Telephone Number accurately.

- Complete your personal details by entering your Last Name, First Name, and Date of Birth in the specified format.

- If applicable, provide information about Spousal and Additional Owners, ensuring to list their names and Dates of Birth. If there are multiple additional owners, attach a separate list.

- Report your Total Household Income by summing line 150 from each required Notice of Assessment or Reassessment, including income from all property owners and spouses.

- Review the Statement to be Signed by the Applicant. Read the acknowledgments regarding your principal residence and other eligibility conditions.

- Collect signatures from yourself, your spouse, and any additional owners if applicable, and enter the date of the application.

- Finalize your application by saving all changes, and being prepared to download, print, or share the form as needed.

Get started on your application now to ensure you secure your property tax relief benefits online.

If you are a senior citizen and/or disabled with your primary residence in Washington, the Property Tax Exemption for Senior Citizens and Disabled Persons program may help you pay your property taxes. ... If the prior year application is approved, a refund in prior years' taxes may be available (up to three years).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.