Loading

Get Declarao-art 99 Do Cirs (2).doc - Esenf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declarao-art 99 Do CIRS (2).doc - Esenf online

This guide provides users with clear instructions on how to effectively complete the Declarao-art 99 Do CIRS (2).doc - Esenf form online. By following these steps, users can ensure that all necessary information is accurately filled out for tax purposes.

Follow the steps to complete your form accurately.

- Press the ‘Get Form’ button to access the Declarao-art 99 Do CIRS (2).doc - Esenf form, opening it in your preferred online editor.

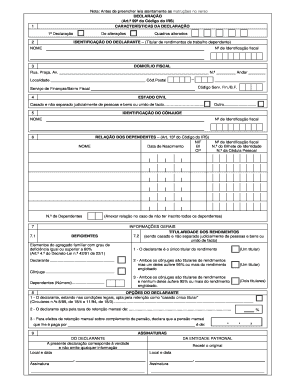

- In the 'Caracteristicas da Declaração' section, indicate whether this is your first declaration or a declaration of changes by marking the relevant box with an 'X'. If making changes, specify the number of the altered fields.

- Proceed to the 'Identificação do Declarante' section. Here, enter your full name and your number of identification fiscal (NIF) for proper identification.

- In the 'Domicílio Fiscal' section, fill in your complete fiscal address, including the street, number, locality, postal code, and any relevant tax service identification.

- Move to the 'Estado Civil' section, where you need to indicate your marital status. Choose from the provided options using an 'X' to select the appropriate status.

- If you are married or in a civil partnership, fill out the 'Identificação do Cônjuge' with their name and identification number.

- In the 'Relação dos Dependentes' section, list all dependents, including their names, identification numbers, dates of birth, and identification document numbers, ensuring accuracy to meet tax criteria.

- In the 'Informações Gerais', state the ownership of income by selecting the applicable option regarding income holders within your household.

- In the 'Opções do Declarante' section, elect the applicable withholding options based on your legal circumstances. Be mindful to ensure your selections align with legislation to avoid errors.

- Finally, in the 'Assinaturas' section, provide your signature along with the signature of the employer or entity, confirming the truth of the declaration. Include the date and location.

- Once all fields are appropriately filled, you can save your changes, download, print the form, or share it as needed.

Complete your tax documents online efficiently to ensure compliance and accuracy.

Example of Vouchers Demand note, cash receipt, cash memo, etc. Duplicate or carbon copy of cash receipt, contracts and correspondence with payee, etc. Cheques, counterfoils, bank statements, etc. Bank deposit slip, bank statements, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.