Loading

Get Sfn41263 Employer's Contribution And Wage Report 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SFN41263 Employer's Contribution And Wage Report 2015 online

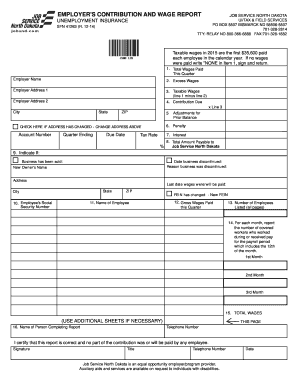

Filling out the SFN41263 Employer's Contribution And Wage Report 2015 online is a straightforward process that helps employers report their taxable wages and contributions accurately. This guide provides a step-by-step approach to ensure you complete the form correctly.

Follow the steps to complete your online submission of the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer name and address in the designated fields. Ensure the information is accurate to avoid any discrepancies.

- In Item 1, report the total wages paid during the quarter. If no wages were paid, write 'NONE'.

- Provide the amount of excess wages, if applicable, in Item 2. This is the amount that exceeds taxable wages.

- Calculate the taxable wages in Item 3 by subtracting Item 2 from Item 1. This amount will be used to determine contribution due.

- In Item 4, report the contribution due by multiplying the amount in Item 3 by the applicable tax rate.

- Indicate any penalties in Item 6 by completing the necessary fields if penalties apply.

- If your address has changed, check the appropriate box and update your employer address.

- Complete the items concerning business changes, including selling the business or discontinuing operations.

- Report employee details including their social security numbers and the gross wages paid for the quarter in Items 10-12.

- Indicate the total number of employees listed across all pages, ensuring all workers receiving wages are accounted for.

- For each month, report the number of covered workers who were employed during the payroll period including the 12th of the month in Item 14.

- Finally, provide your name, telephone number, and title in Item 16. Certify that the report is correct by signing where indicated.

- Once all sections are completed and reviewed, save the changes, and consider downloading or printing a copy for your records.

Complete your SFN41263 Employer's Contribution And Wage Report 2015 online today for an efficient submission.

What Makes A Good Logo? # A good logo is distinctive, appropriate, practical, graphic and simple in form, and it conveys the owner's intended message. A concept or “meaning” is usually behind an effective logo, and it communicates the intended message.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.