Loading

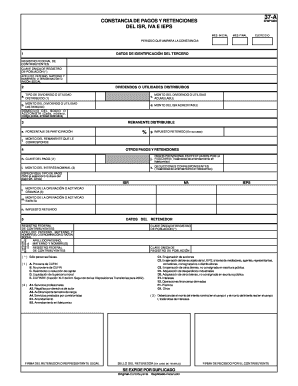

Get Constancia De Retenciones 37 A Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Constancia De Retenciones 37 A Form online

Filling out the Constancia De Retenciones 37 A Form online can seem daunting. This guide will provide you with a clear and user-friendly walkthrough of each section and field within the form, ensuring that you have all the necessary information to complete it accurately.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor of choice.

- Fill in the initial month and final month fields related to the period you are documenting.

- In the third section, provide the identification details for the third party, including their Federal Tax Registration number, Unique Population Registration code, and full name or corporate name.

- For the type of dividends or profits distributed, select from the relevant options and indicate the total amount of dividends or profits allocated.

- Report the payable amounts, which includes the intermediate interest and the retained taxes, if applicable.

- Complete the data pertaining to the person or entity making the retention, including their Federal Tax Registration number and any pertinent legal representative details.

- Ensure that all fields are filled out correctly, double check for any errors, and then proceed to save your changes.

- After completing the form, you can download, print, or share the document as needed.

Start filling out your documents online today for a more efficient process.

El CFDI de retención e información de pagos podrá emitirse de manera anualizada en el mes de enero del año inmediato siguiente a aquél en que se realizó la retención o pago.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.