Loading

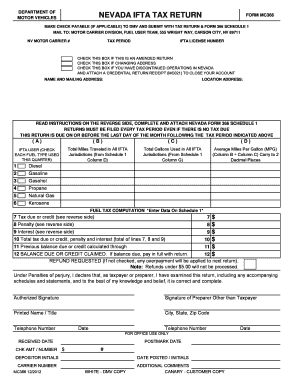

Get Make Check Payable (if Applicable) To Dmv And Submit With Tax Return & Form 366 Schedule 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the MAKE CHECK PAYABLE (IF APPLICABLE) TO DMV AND SUBMIT WITH TAX RETURN & FORM 366 SCHEDULE 1 online

Filling out the MAKE CHECK PAYABLE form is an essential step for individuals and organizations submitting their tax returns and Form 366 Schedule 1 to the Department of Motor Vehicles. This guide provides clear, step-by-step instructions to ensure accurate completion of the form, making the filing process efficient and straightforward.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access and open the form in your preferred digital editing environment.

- Fill in your Nevada Motor Carrier Number at the top of the form. This is necessary for identifying your account and tax submissions.

- Enter the tax period for which you are filing the return. Ensure that the dates align with the reporting period relevant to your tax obligations.

- Check the appropriate boxes indicating if the return is amended, if there is a change of address, or if operations in Nevada have been discontinued.

- Provide your name and mailing address in the designated fields. Make sure all information is accurate to avoid processing delays.

- Complete the location address field, which identifies where your operations are based.

- Follow the instructions on the reverse side to complete Nevada Form 366 Schedule 1, which is required to accompany this form.

- In the section labeled 'Total Miles Traveled in All IFTA Jurisdictions', enter the total miles driven during the applicable tax period.

- Input the total gallons of fuel used in the same jurisdictions, as indicated on Schedule 1.

- Calculate the average miles per gallon (MPG) for each fuel type used, ensuring your calculations carry to two decimal places, and enter the results in the corresponding fields.

- Complete the tax computation information as required, including tax due, any penalties, and interest if applicable.

- Review your entries for accuracy. Ensure each section is filled out, all calculations are correct, and fields are not left blank.

- Once all the information is complete, proceed to save the form. You may download, print, or share it as necessary for submission.

Complete your documents online today to ensure timely and accurate filing.

Acceptable Proof of Payment — Upon renewal of registration, any of the following may be accepted as proof of FHVUT payment: The original or photocopy of an IRS receipt Schedule 1, Form 2290.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.