Loading

Get Transfer Form For Non Market Transactions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Form For Non-Market Transactions online

This guide provides clear, step-by-step instructions on completing the Transfer Form For Non-Market Transactions online. Whether you are a first-time user or familiar with digital document management, this guide will assist you in filling out the form accurately and efficiently.

Follow the steps to fill out the Transfer Form For Non-Market Transactions effectively.

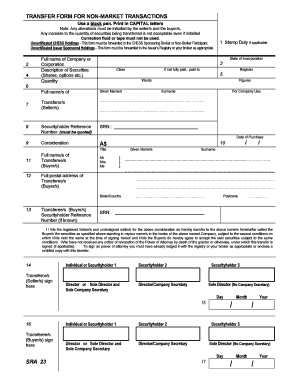

- Click the ‘Get Form’ button to access the Transfer Form For Non-Market Transactions and open it in your preferred digital editor.

- Fill in the stamp duty section if applicable. Note that transfers of listed securities are generally exempt from stamp duty, while other securities require the buyer to calculate and pay the duty based on the consideration value.

- In the 'Full name of Company or Corporation' field, enter the complete name of the entity holding the securities.

- Specify the state of incorporation for the company entered in the previous step.

- Describe the securities being transferred, such as shares or options, including any relevant identifiers.

- Input the quantity of securities being transferred, using both words and figures to ensure clarity.

- Complete the 'Full name/s of Transferor/s (Seller/s)' section by providing the full names of the sellers.

- Enter the Securityholder Reference Number (SRN) in the designated field, as this is critical for non-certificated securities.

- Detail the consideration amount for the securities, as this reflects the purchase price agreed upon by the parties.

- Record the date of purchase or the completion date of the transfer in the provided field.

- In the 'Full name/s of Transferee/s (Buyer/s)' section, include the full names of the buyers, ensuring compliance with naming regulations.

- Complete the 'Full postal address of Transferee/s' section with an accurate postal address, including the postcode.

- If applicable, input the existing SRN of the buyer for tracking purposes.

- Both sellers must sign the form where indicated. Ensure compliance with signing protocols, including joint holdings and roles such as power of attorney.

- Document the date signed by the sellers in the appropriate section.

- Buyers must sign in the indicated area, with note of joint holdings and associated signing requirements.

- Input the date signed by the buyers to finalize this section.

- Review the completed form for accuracy, ensuring all fields are filled correctly, and save your changes. You can then download, print, or share the document as needed.

Complete your Transfer Form For Non-Market Transactions online today for a smooth process.

The Share Transfer Form (also called the Share Transfer Instrument) is a standard document required for the transfer of shares in a company. It is used when a shareholder intends to sell or transfer their company shares to another party.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.