Loading

Get 2015 150-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

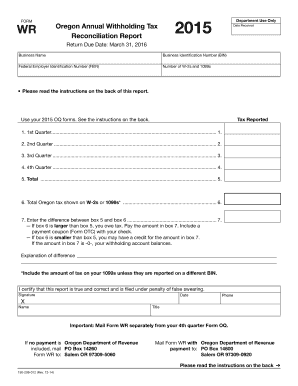

How to fill out the 2015 Oregon Combined Payroll Tax Report online

This guide provides detailed instructions for completing the 2015 Oregon Combined Payroll Tax Report online. It is designed to assist users with varying levels of experience in filling out crucial payroll tax documents accurately and efficiently.

Follow the steps to complete your report with ease.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Ensure that all required details are completed correctly. Start by entering your business name and Oregon Business Identification Number (BIN). These are essential for identification and processing of your report.

- Fill in the Federal Employer Identification Number (FEIN). This number is used for federal tax purposes, and accuracy is crucial.

- On lines 1 through 4, enter the total Oregon tax reported for each quarter using the amounts from your 2015 OQ forms.

- Calculate and enter the total amount from all quarters on line 5. This step summarizes your tax obligations for the year.

- Line 6 should reflect the total Oregon tax withheld from your employees' W-2s or 1099 forms.

- For line 7, calculate the difference between line 5 (total tax paid) and line 6 (total tax shown from W-2s or 1099s). If line 6 is larger, you owe additional tax; if smaller, you may have a credit.

- Sign and date the completed report, providing your name and phone number for any follow-up queries.

- If tax payment is due, make it along with the report. Do not staple or tape payments to the Form WR.

- Mail Form WR to the appropriate address according to whether you are including payment or not, ensuring timely processing.

Complete your 2015 Oregon Combined Payroll Tax Report online to ensure compliance and avoid potential penalties.

The Oregon Legislature approved the new tax in 2017 to help pay for a large package of statewide transportation improvements. The transit tax amounts to $1 for each $1,000 workers earn in Oregon. It took effect last summer, and employers were directed to begin deducting it automatically from paychecks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.