Loading

Get Mortgage Disclosure Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Disclosure Statement online

Filling out the Mortgage Disclosure Statement online can be straightforward if you follow a clear process. This guide will help you understand each section of the form, providing step-by-step instructions to ensure you complete it accurately.

Follow the steps to successfully complete the Mortgage Disclosure Statement.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering the borrower's name(s) in the designated field. Ensure that the names match the identification documents of all individuals applying for the mortgage.

- Provide the real property collateral information. This includes the street address or legal description of the property for which the loan is being requested.

- If known, list the intended lender to whom your loan application will be delivered. Otherwise, select the option for unknown.

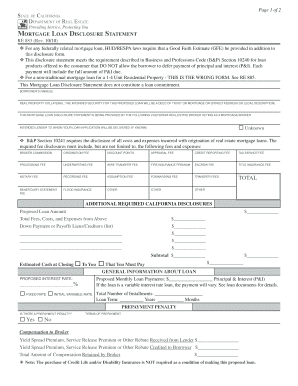

- Disclose all applicable fees and expenses incurred during the loan origination. Fill out items such as broker commission, origination fee, discount points, appraisal fee, and any other fees mentioned.

- Input the proposed loan amount along with total fees, costs, and expenses in their respective fields. Include details for any down payment or payoff of liens/creditors.

- Complete the section for general loan information, including proposed interest rate, proposed monthly payments, loan term, and if there is a prepayment penalty.

- List any other liens on the property, along with the lienholder’s name, amount owing, and priority.

- If applicable, indicate if the loan is subject to a balloon payment. Provide the due date and balance due at maturity.

- Confirm whether the loan will be made from broker controlled funds and complete the certification regarding compliance with applicable real estate laws.

- Lastly, make sure all sections of the form are completed before signing. Ensure that both borrower(s) and broker's representative have signed and dated as necessary.

- After filling out the form, you can save your changes, download a copy for your records, print the document, or share it as needed.

Complete your Mortgage Disclosure Statement online today for a smoother mortgage process!

Cleared to Close (3 days) A final Closing Disclosure detailing all of the loan terms, costs and other details will be prepared by your lender and provided to you for review. There is a mandatory three-day waiting period after you receive the Closing Disclosure before you can sign your loan documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.