Loading

Get Pc-246 New 713

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PC-246 NEW 713 online

Filling out the PC-246 NEW 713 financial report for a decedent's estate can seem complex, but this guide will simplify the process. Follow the step-by-step instructions to accurately complete the form online and ensure compliance with the necessary requirements.

Follow the steps to successfully complete the PC-246 NEW 713 form.

- Click the ‘Get Form’ button to access the financial report online, ensuring that you have the form ready in your editing environment.

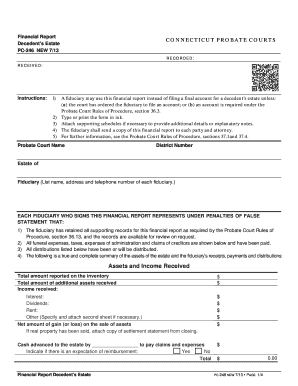

- Begin by entering the probate court name and the district number at the top of the form. This identifies the jurisdiction handling the estate.

- Complete the 'Estate of' section by providing the name of the deceased individual whose financial affairs are being reported.

- In the fiduciary section, list the names, addresses, and telephone numbers of all fiduciaries managing the estate.

- Review the declarations made by each fiduciary regarding supporting records, payments of claims, and distributions by checking the appropriate boxes.

- Fill in the 'Assets and Income Received' section detailing the total amount reported on the inventory, additional assets received, and any income generated. Specify sources such as interest and dividends.

- Document any cash advanced to the estate by indicating the amount and whether there is an expectation of reimbursement.

- Proceed to the 'Payments' section, where you will list all funeral and administrative expenses, including any fees associated with fiduciaries and attorneys.

- In the 'Distributions' section, both already made and proposed distributions must be recorded, detailing the name of the distributee, the assets distributed, and their fair market value.

- Finally, ensure all fiduciaries provide their signatures, print their names, and date the form, certifying the accuracy of the information provided.

- Once completed, review the form for accuracy. Save your changes, then download, print, or share the form as needed.

Start completing the PC-246 NEW 713 form online today to manage estate affairs effectively.

How large the estate is - previous law maxed capped fees at $12,500, but in 2015 that cap was removed; now estates exceeding a $2M value will pay a flat rate (currently $5615) plus an additional ½ percent of the gross estate value over $2M. Where the estate is located (different counties can have different fees)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.