Loading

Get E 500 Web Fill

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E 500 Web Fill online

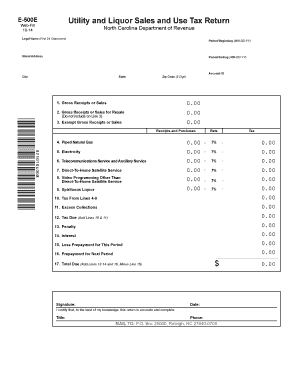

The E 500 Web Fill is an essential form for reporting utility and liquor sales and use tax in North Carolina. This guide provides detailed, step-by-step instructions to help users navigate the online process with ease and confidence.

Follow the steps to fill out the E 500 Web Fill efficiently.

- Click the 'Get Form' button to obtain the form and access it online.

- Begin by entering your legal name in the designated field. Ensure that you use only the first 24 characters, as there is a character limit.

- Input the period beginning and ending dates using the MM-DD-YY format. This section allows you to specify the timeframe for the sales being reported.

- Fill in your street address, city, state, account ID, and zip code in the corresponding fields. This information is critical for identifying your account.

- Enter the gross receipts or sales for the period in line 1. This line captures the total amount of revenue generated.

- If applicable, include the gross receipts or sales for resale in line 2. Remember to exclude this amount from line 3.

- In line 3, report exempt gross receipts or sales. This includes any sales that are exempt from taxation.

- Complete lines 4 to 9 with the respective gross receipts for specific categories such as piped natural gas, electricity, telecommunications services, direct-to-home satellite service, video programming, and spirituous liquor. Calculate the tax for each by multiplying the amount by the 7% tax rate.

- In line 10, sum the taxes calculated in lines 4-9 to determine the total tax due.

- Record any excess collections in line 11, if applicable.

- Add lines 10 and 11 in line 12 to find the total tax due.

- If any penalties apply, enter the amount in line 13, followed by any interest owed in line 14.

- In line 15, subtract any prepayment made for this period.

- Enter any prepayment for the next period in line 16.

- Finally, calculate the total due by adding lines 12, 14, and 16, then subtract line 15. Record this amount in line 17.

- Sign and date the form at the bottom. Include your title and phone number for reference.

- Once all fields are completed, you can save your changes, download, print, or share the completed form as needed.

Complete your E 500 Web Fill online today to ensure your tax compliance.

You can use a copy of your original return or one of the additional report forms provided in the back of your tax payment forms booklet to make the corrections to the applicable period. The report form should be marked "AMENDED" and forwarded to the Department with any additional tax, penalty and interest due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.