Loading

Get Form Rf-01 Application For Registration As Dealer.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RF-01 Application For Registration As Dealer.pdf online

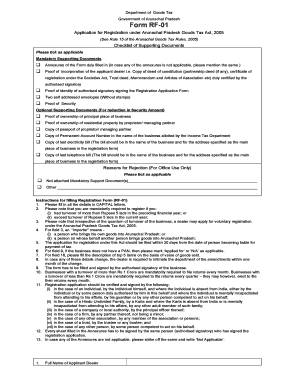

Navigating the process of completing the Form RF-01 Application For Registration As Dealer online can be straightforward with the right guidance. This document is essential for dealers looking to register under the Arunachal Pradesh Goods Tax Act, and this guide will provide step-by-step instructions to ensure you fill it out correctly.

Follow the steps to successfully complete the application form online.

- Press the ‘Get Form’ button to download and open the form in your preferred online editor.

- Begin by filling in your full name in capital letters in the designated field.

- Enter your trade name, if applicable, to represent your business.

- Select the nature of your business from the provided options, marking all that apply.

- Indicate the constitution of your business, ensuring you tick the appropriate option.

- Choose the type of registration (mandatory or voluntary) and provide your annual turnover details.

- Specify the date from which you are liable for registration under the Goods Tax Act.

- Fill in your Permanent Account Number (PAN) in the corresponding field.

- Provide the principal place of business details including building name, town, district, and pin code.

- List any additional places of business, if applicable, using the annexures for detailed information.

- Complete the details of all bank accounts associated with your business.

- Affirm the provided information by signing the form. Ensure that the signature is by the authorized signatory.

- Review the document for accuracy and completeness before finalizing.

- Once filled, you can save changes, download, print, or share the completed form as required.

Start filling out the RF-01 Application for Registration As Dealer online to ensure your compliance with the Arunachal Pradesh Goods Tax Act.

Related links form

Term of the Lease: This clause specifies the start and end dates of the tenancy. The lease can be for a fixed term, such as one year, or a periodic tenancy, which is renewed automatically unless either party gives notice to terminate the lease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.