Loading

Get A1 Qrt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A1 Qrt online

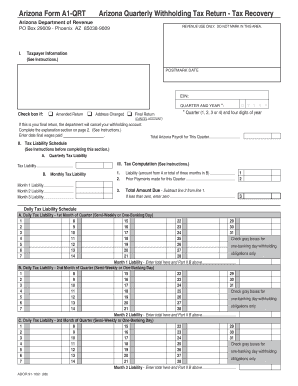

Filling out the Arizona Quarterly Withholding Tax Return, known as the A1 Qrt, is an important task for employers managing payroll taxes. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to complete the A1 Qrt form online.

- Click ‘Get Form’ button to obtain the Arizona Quarterly Withholding Tax Return and open it in your preferred online editor.

- Enter your EIN in the designated field. This number is essential for identifying your business with the Arizona Department of Revenue.

- Specify the quarter and year for which you are reporting. Use the format of the quarter number followed by the four digits of the year.

- If applicable, check the boxes indicating whether this is an amended return, if your address has changed, or if this is your final return.

- Complete the section for total Arizona payroll for the specified quarter. This figure is vital for tax calculations.

- Proceed to the Tax Liability Schedule. Here, fill in your quarterly and monthly tax liabilities for the specified period.

- Calculate the total tax liability by referencing the amounts from the previous sections. Deduct any prior payments made for the quarter.

- In the Daily Tax Liability Schedule, record the daily responsibilities for each month of the quarter. Ensure you check the appropriate boxes for one-banking day withholding obligations.

- If submitting an amended return, provide a brief explanation of the reason for doing so.

- Finally, sign the return, include the preparer's information if applicable, and ensure that all required areas are filled out to avoid delays.

- Once you have verified all information and filled out the form completely, you can save changes, download, print, or share the completed form.

Begin filling out your documents online today to ensure compliance and avoid penalties.

Employers that remit Arizona income tax on any of the following schedules must file Form A1-QRT to reconcile their withholding deposits for the calendar quarter: • Quarterly • Monthly • Semi-weekly • Next day Form A1-QRT is also used as: • The payment transmittal form for payments made on a quarterly basis when those ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.