Loading

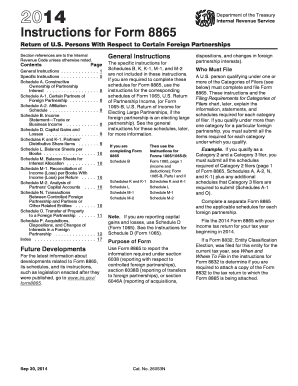

Get Distributive Share Items - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Distributive Share Items - Irs online

Completing the Distributive Share Items - Irs is essential for reporting your share of income, deductions, and other items from partnerships. This guide offers a clear step-by-step approach for filling out the form online, ensuring that users can navigate the process confidently, regardless of their legal experience.

Follow the steps to accurately submit your Distributive Share Items - Irs online.

- Press the ‘Get Form’ button to access the form and initiate the online process.

- Identify your category as a filer by checking the appropriate boxes on the form. Make sure you understand whether you qualify as a Category 1, 2, 3, or 4 filer based on your relationship with the foreign partnership.

- Fill in your identifying information, including your Employer Identification Number (EIN) or Social Security Number (SSN), and the address of the foreign partnership.

- Complete Schedule A to report constructive ownership of partnership interests. Ensure that all direct or constructive interests are accurately reflected.

- If applicable, proceed to fill out Schedule A-1, detailing the certain partners of the foreign partnership that hold a direct interest.

- Fill out Schedule K, summarizing the distributive share items and their allocations among partners.

- Complete Schedule K-1 for any direct interest held in the partnership. This schedule should reflect each partner's share of income, deductions, credits, etc.

- Finalize any remaining schedules that apply to your reporting situation, such as Schedule B for trade or business income.

- Review all entered information carefully for accuracy before finalizing your submission.

- Once all sections are completed, save your changes, then download, print, or share your form as necessary.

Start filling out your Distributive Share Items - Irs online today to ensure accurate reporting and compliance.

For most partners in partnerships, totals in Schedule K-1 get included on Schedule E of the partner's income tax return (usually Form 1040). Part II of Schedule E is "Income or Loss From Partnerships and S Corporations." In this section, the partner must report partnership income and loss for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.