Loading

Get Refund Application (r0311c) - Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Refund Application (R0311C) - Michigan online

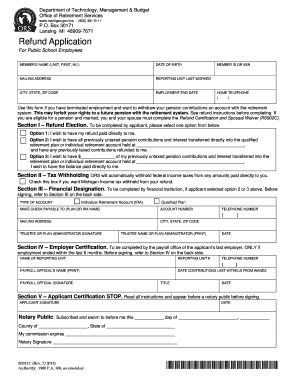

This guide is designed to assist users in accurately filling out the Refund Application (R0311C) for Michigan's Office of Retirement Services. By following these step-by-step instructions, users can ensure that their application is completed correctly and submitted for processing.

Follow the steps to complete your Refund Application online

- Click the ‘Get Form’ button to obtain the Refund Application (R0311C) and open it for editing.

- Begin by entering the member’s name, date of birth, and mailing address in the designated fields at the top of the form.

- Provide the reporting unit last worked, city, state, zip code, employment end date, member ID or Social Security number, and home telephone number in the specified fields.

- In Section I, Refund Election, carefully read the options provided. Select one option that aligns with your request for the refund payment.

- If you choose Option 2 or 3 in Section I, complete Section II by indicating if you want Michigan income tax withheld from your refund.

- For Option 2 or 3 selection, Section III must be filled out by your financial institution. Provide the type of account, make check payable to, account number, mailing address, telephone number, and the trustee or plan administrator’s signature.

- If your employment ended within the last six months, Section IV needs to be completed by the payroll office of your last employer. Ensure they provide the necessary information and signatures before submission.

- Read the instructions in Section V carefully. Sign and date the application, ensuring you understand the terms outlined regarding your rights and election.

- Once all sections are complete, you can save your changes, download the document, print it for mailing, or share it as needed. Submit the completed application to the Office of Retirement Services at the specified address.

Complete your Refund Application online today to ensure a smooth processing experience.

Step 1: If you prepared and e-filed your Michigan state tax return on eFile.com, sign in to your eFile.com account and check your Michigan filing status by clicking on My Return in the upper left menu - see image below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.