Loading

Get Request For Copy Of The Return Estate Or Gift Certificate Of Release - Hacienda Pr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Copy Of The Return Estate Or Gift Certificate Of Release - Hacienda Pr online

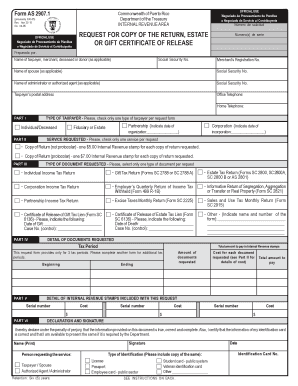

Filling out the Request For Copy Of The Return Estate Or Gift Certificate Of Release is a straightforward process that allows users to obtain important tax documents. This guide will provide step-by-step instructions on how to complete the form online, ensuring you have all necessary information ready for submission.

Follow the steps to successfully complete your request online.

- Press the ‘Get Form’ button to access the form in an online editor.

- Begin by entering the series numbers relevant to your request at the top of the form. Ensure accuracy to avoid processing delays.

- In the 'Name of taxpayer, merchant, deceased or donor' section, fill in the name relevant to the request. If applicable, include details for the spouse or authorized agent.

- Provide the social security numbers for the taxpayer, spouse, and authorized agent where required.

- Fill out the taxpayer's postal address, ensuring that it is complete for any correspondence.

- Choose the type of taxpayer you are by checking only one option in Part I and indicate accordingly whether you are an individual, fiduciary, partnership, or corporation.

- In Part II, check the service you are requesting, choosing either a copy of return or a certificate of release. Make sure to include the correct internal revenue stamp payment as indicated.

- Select the type of document you are requesting in Part III. Make sure to choose only one type per request for proper processing.

- In Part IV, detail the documents requested by entering the tax period and the total amount for which you are applying. If you need copies for more than three tax periods, prepare additional forms.

- In Part V, indicate the details of the internal revenue stamps attached with your request, making sure to include the serial number.

- Complete the declaration and signature section, ensuring that all requested signatures and costs for each document are accurately entered.

- After reviewing all the entered information, save your changes, then proceed to download, print, or share the finalized form as needed.

Complete your documents online today to simplify your tax-related requests.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Currently, there is a 10% tax on property transferred by gift or inheritance that is not subject to exemption. Recipients of property that is subject to gift or inheritance taxation may increase their tax basis by the fair market value of the property at the time of the transfer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.