Loading

Get Lease/lessor Information For 2015-2017 Cycle - Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LEASE/LESSOR INFORMATION FOR 2015-2017 CYCLE - Nj online

Filling out the LEASE/LESSOR INFORMATION FOR 2015-2017 CYCLE form is an essential step for anyone leasing equipment. This guide provides clear, step-by-step instructions to help you complete the form correctly and efficiently, ensuring all necessary information is included.

Follow the steps to successfully fill out the form online.

- Press the ‘Get Form’ button to access the document, allowing you to start filling it out in an editable format.

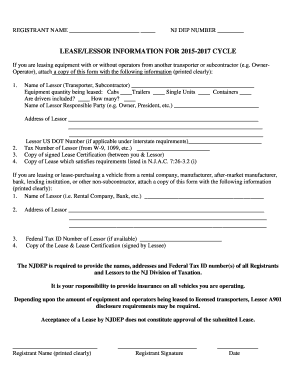

- Begin by entering the registrant name and NJ DEP number at the top of the form. Ensure this information is printed clearly to avoid any processing delays.

- In the 'LEASE/LESSOR INFORMATION' section, specify the name of the lessor, whether they are a transporter or subcontractor, along with the equipment quantity being leased. Provide details about the vehicles including cabs, trailers, single units, and containers.

- Indicate whether drivers are included in the lease and specify the number of drivers, if applicable.

- Fill out the name of the lessor’s responsible party, typically the owner or president. Also, provide the full address of the lessor.

- If applicable, enter the lessor's US DOT number and tax number as required. Attach a signed lease certification that binds you with the lessor.

- Include a copy of the lease that satisfies the requirements outlined in New Jersey Administrative Code (N.J.A.C. 7:26-3.2(i)). Ensure that all documents are securely attached.

- If leasing from a rental company or institution, complete the corresponding fields with the company name, address, and Federal Tax ID number, if available.

- Lastly, carefully review all entered information for accuracy. Save your changes and prepare the form for submission by downloading, printing, or sharing, as required.

Complete your document online today to ensure timely processing!

Sales tax in NJ is computed as follows monthly base lease payments x term x sales tax rate. ... cash rebates and customer cash cap reductions are taxable. Trade-ins are not taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.