Loading

Get Brunswickcountync Gov Forms Propertylisting

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Brunswickcountync Gov Forms Propertylisting online

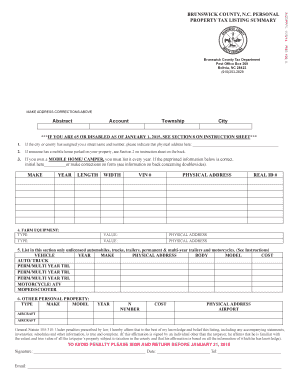

Filling out the Brunswick County personal property tax listing form is essential for ensuring compliance with local tax regulations. This guide will provide you with clear, step-by-step instructions on how to effectively complete the form online, helping you avoid any penalties or complications.

Follow the steps to successfully complete the propertylisting form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Indicate your physical address in the designated field. If you have a street name and number assigned by the city or county, provide that information here.

- If there is a mobile home or camper on your property that does not belong to you, refer to the instructions in Section 2 on the back of the form, and provide the owner’s name and address in the relevant fields.

- If you own a mobile home or camper, ensure you list it annually. Indicate the make, year, length, width, and physical address. If the information provided is accurate, initial where indicated.

- For farm equipment, list the type, value, and physical address of any equipment you own in Section 4. If necessary, use additional paper for extensive lists.

- Section 5 requires you to list unlicensed automobiles, trucks, trailers, and motorcycles. Fill in the vehicle details including year, make, model, body type, and the physical address where the vehicle is located.

- In Section 6, detail any other personal property such as aircraft by providing the type, make, model, year, N-number, and cost along with the physical address.

- Complete the affirmation statement, sign, and date the form. Include your telephone number and email address for any follow-up communications.

- After you have filled out all necessary fields, review the information for accuracy. Save changes, download, or print the form for your records as needed before submitting it.

- Return the completed form to the Brunswick County Tax Office by mailing it to the provided address, ensuring it is postmarked no later than January 31 to avoid penalties.

Complete the Brunswick County personal property tax listing form online today to ensure your compliance and avoid late fees.

In many cases, the first step is to contact the tax office informally and seek to resolve the difference without filing a formal appeal. If the appeal cannot be settled informally, the taxpayer may appeal to the local Board of Equalization and Review, which begins its deliberations around the first week in April.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.