Loading

Get Dr 1305 - Colorado.gov - Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DR 1305 - Colorado.gov - Colorado online

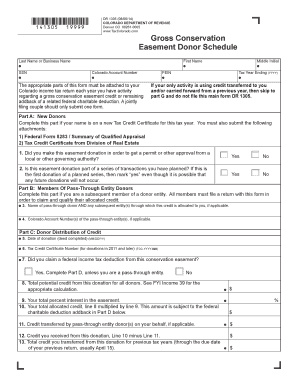

The DR 1305 form is a key document used by individuals seeking to claim gross conservation easement tax credits in Colorado. This guide will provide clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out the DR 1305 form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your last name or business name, followed by your social security number (SSN) and first name. If applicable, also include your Colorado account number and middle initial.

- Indicate the tax year ending by entering the year in 'YYYY' format.

- If your only activity involves using credit carried forward from prior years or transferred to you, proceed to Part G and do not fill out the main sections of the DR 1305 form.

- In Part A, if your name appears on a new Tax Credit Certificate, answer the questions honestly regarding your donation's intentions and whether it is part of a series of planned transactions.

- For Part B, fill out the required information if you are a member of a pass-through entity donor, including the name of the pass-through entity and relevant account numbers.

- In Part C, accurately provide details about the donation, including dates, total potential credit, percent interest in the easement, and any credits received. Ensure to perform the calculations as instructed.

- Complete Part D if you claim a federal income tax deduction from the conservation easement by providing necessary figures and calculations for current and prior years.

- For Parts E through G, attach any additional pages as needed and follow the specific instructions for documenting any extra information pertinent to your case.

- Once you have filled in all necessary details, save the changes. You can download, print, or share the completed form as required.

Complete your DR 1305 form online today to ensure a smooth filing process.

You may qualify for the State Child Tax Credit if: You are a single filer with a Federal Adjusted Gross Income up to $75,000. You are a joint filer with a Federal Adjusted Gross Income up to $85,000. Child/Dependents are under the age of six at the end of the year (Dec.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.