Loading

Get O.c.g.a. 48-7-40.26

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the O.C.G.A. 48-7-40.26 online

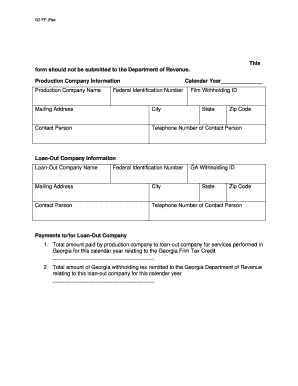

The O.C.G.A. 48-7-40.26 form is essential for documenting income tax withholding for payments made to Loan-Out Companies under the Georgia Film Tax Credit program. This guide provides a step-by-step approach to accurately complete the form online.

Follow the steps to complete the O.C.G.A. 48-7-40.26 form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the Production Company information, including the name, calendar year, federal identification number, film withholding ID, mailing address, city, state, zip code, contact person, and their telephone number.

- Provide the Loan-Out Company information. Fill in the Loan-Out Company name, federal identification number, GA withholding ID, mailing address, city, state, zip code, contact person, and their telephone number.

- Complete the payments section. First, input the total amount paid by the production company to the Loan-Out Company for services performed in Georgia for the specified calendar year.

- Next, indicate the total amount of Georgia withholding tax that has been remitted to the Georgia Department of Revenue for this Loan-Out Company for that calendar year.

- Review all entries for accuracy. Once confirmed, you may choose to save changes, download, print, or share the completed form as needed.

Start filling out your documents online today!

A production is required to spend a minimum of $500,000 in Georgia qualified expenditures to qualify for the film tax credit. Costs for pre-production, production, and post-production related to filming in Georgia are qualified expenditures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.