Loading

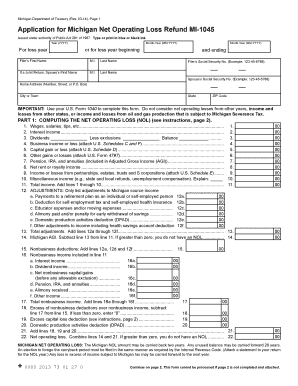

Get 2013 Application For Michigan Net Operating Loss Refund Mi-1045 - Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Application For Michigan Net Operating Loss Refund MI-1045 - Michigan online

This guide provides expert instructions on filling out the 2013 Application for Michigan Net Operating Loss Refund MI-1045. Whether you are familiar with tax forms or navigating this process for the first time, this comprehensive guide is designed to help you complete the application thoroughly and accurately.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to retrieve the application form and open it in your preferred editing tool.

- Fill in the 'Year' field with the correct year (YYYY) you are applying for the refund and the 'Month-Year' fields indicating the start and end of the loss year.

- Enter your personal information in the 'Filer’s First Name', 'M.I.', and 'Last Name' fields. If applicable, also include your spouse’s details.

- Provide your Social Security Number and your spouse's Social Security Number if filing jointly.

- Input your complete home address, including the city, state, and ZIP code.

- In Part 1, begin calculating your net operating loss (NOL) by using your U.S. Form 1040. Fill out the income section, listing wages, interest, dividends, and any other income you received.

- List adjustments to Michigan source income in the adjustments section, detailing any relevant payments and deductions as outlined.

- Complete the required calculations to derive your Michigan Adjusted Gross Income (AGI) in accordance with the provided guidelines.

- Continue to follow the instructions meticulously for Parts 1 and 2 to ensure you are accurately reporting both your income and tax information related to your NOL.

- Review all entered information for accuracy before proceeding to save, download, print, or share your completed application.

Complete your application for a Michigan Net Operating Loss Refund MI-1045 online today!

NOL Steps Complete your tax return for the year. ... Determine whether you have an NOL and its amount. ... If applicable, decide whether to carry the NOL back to a past year, or to waive the carryback period and instead carry the NOL forward to a future year. ... Deduct the NOL in the carryback or carryforward year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.