Loading

Get Form Loa Loan-out Affidavit /allocation - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form LOA Loan-Out Affidavit /Allocation - Mass.Gov - Mass online

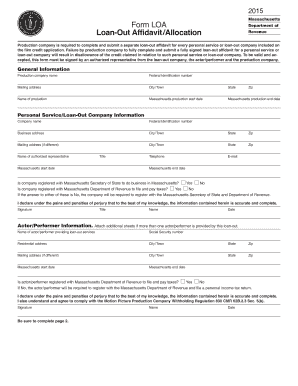

Filling out the Form LOA Loan-Out Affidavit /Allocation is an important step for production companies in Massachusetts seeking to claim tax credits. This guide provides a clear overview and step-by-step instructions to help you complete the form accurately and confidently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the preferred editing tool.

- Begin by filling out the general information section. Provide the production company name, federal identification number, mailing address, city/town, state, name of production, production start date, production end date, and zip code.

- Next, complete the personal service/loan-out company information section. Enter the company name, federal identification number, business address, city/town, state, zip code, and, if applicable, a different mailing address. Include the authorized representative's name and title, as well as the Massachusetts start and end dates.

- Respond to the questions regarding the registration status with the Massachusetts Secretary of State and Department of Revenue. If the answer is 'No' to either question, the company must register accordingly.

- Proceed to the actor/performer information section. Input the title, name, date, social security number, and residential address, ensuring to provide the tax registration status as well.

- Complete the payments to loan-out company section. Here, list the total amount paid to the loan-out company, the amount qualifying for Massachusetts payroll/production credit, and verify that the payments constitute Massachusetts source income.

- Finally, review all information for accuracy and completeness. Ensure signatures are provided by an authorized representative from the production company, the loan-out company, and the actor/performer. Save your changes, and download, print, or share the completed form as necessary.

Complete your documents online with confidence and accuracy.

Description of Pass-through Entity Withholding Agreeing to file and to subject themselves to personal jurisdiction in Massachusetts; Participating in a composite return filed by the pass-through entity; or. Authorizing the pass-through entity to withhold and pay tax on their behalf.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.