Loading

Get Irs Form W-4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

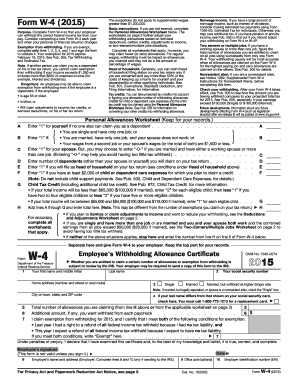

How to fill out the IRS Form W-4 online

Filling out the IRS Form W-4 is crucial for ensuring that your employer withholds the correct amount of federal income tax from your pay. This guide provides clear, step-by-step instructions to help you complete the form accurately online.

Follow the steps to complete your IRS Form W-4 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your personal information, including your first name, middle initial, last name, and your social security number.

- Provide your home address, including city, state, and ZIP code. Make sure the information matches your official documents.

- Select your filing status. You can choose between Single, Married, or Married, but withhold at a higher Single rate.

- If your last name differs from that on your social security card, check the appropriate box and contact the Social Security Administration for a replacement card.

- Determine the total number of allowances you are claiming based on the Personal Allowances Worksheet and enter that number on line 5.

- If you wish to withhold an additional amount from each paycheck, specify that amount on line 6.

- If you are claiming exemption from withholding, make sure to meet the specified conditions, write ‘Exempt’ on line 7, and ensure you sign the form.

- Under penalties of perjury, sign and date the form to complete it. This step is necessary for the form to be valid.

- After completing the form, you can save changes, download, print, or share the form as needed.

Complete your IRS Form W-4 online today to ensure accurate tax withholding.

Related links form

On December 5, the IRS issued the redesigned 2020 Form W-4 (Employee's Withholding Certificate). The new form no longer uses withholding allowances. Instead, there is a five-step process and new Publication 15-T (Federal Income Tax Withholding Methods) for determining employee withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.