Loading

Get Request For In Rem Notification - Nyc.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the REQUEST FOR IN REM NOTIFICATION - NYC.gov online

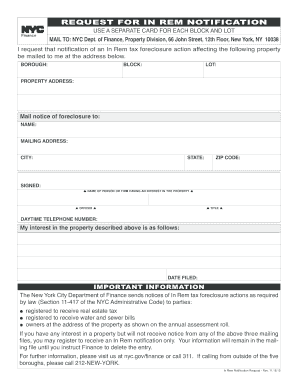

This guide provides step-by-step instructions for completing the Request for In Rem Notification form, an essential document for individuals wishing to receive notifications regarding In Rem tax foreclosure actions in New York City. Whether you have legal experience or not, this user-friendly guide will help you through the process.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- In the first section, fill in the borough where the property is located. Ensure that you select the correct borough to avoid any discrepancies.

- Enter the block number associated with the property. This number identifies the specific parcel of land.

- Provide the full property address, including the street name and number, in the designated field.

- Fill in the lot number linked to the property. This number is essential for pinpointing the exact location within the block.

- In the next fields, specify the name of the person or firm who wishes to receive the notice. This ensures that the right individual receives important information.

- Complete the mailing address by providing the street address, city, state, and ZIP code where notice should be sent.

- Sign the form in the designated space to confirm your request for notification regarding the In Rem tax foreclosure actions.

- Include your daytime telephone number to facilitate communication if necessary.

- Finally, state your interest in the property being listed on the form. This should be a clear explanation of your relationship to the property.

- Once all fields are filled out, you can save the changes, download a copy, print the form, or share it as needed.

Complete your Request for In Rem Notification online to stay informed about your property.

Generally, the redemption period expires two years after the lien date (that is, when the tax or other legal charges became a lien). However, local law may provide a longer redemption period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.