Loading

Get Ttb F 5620 A - Ttb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5620 A - TTB online

Filling out the TTB F 5620 A - TTB form online can streamline the claims process for alcohol, tobacco, and firearms taxes. This guide will provide you with a step-by-step approach to accurately complete the form, ensuring that your submission is clear and compliant.

Follow the steps to successfully complete your TTB F 5620 A - TTB form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

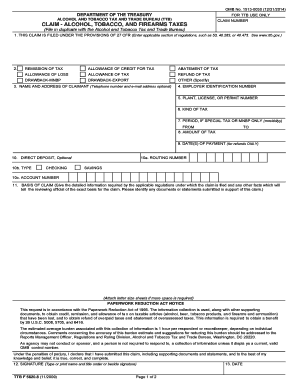

- In item 1, enter the applicable section of the regulations under which you are filing this claim. Refer to TTB regulations for guidance.

- For item 2, select the type of claim you are filing, such as remission of tax, allowance of credit, abatement, allowance of loss, refund, or drawback.

- In item 3, input the name and address of the claimant. Including a telephone number and e-mail address is optional.

- Enter the employer identification number in item 4.

- For item 5, provide the plant, license, or permit number.

- Specify the kind of tax in item 6, such as excise tax or special tax.

- In item 7, input the period the tax was due, applicable only to special tax or nonbeverage claims, in mm/dd/yy format.

- Enter the total amount of tax being claimed in item 8.

- For item 9, specify the date of payment related to refunds only.

- In item 10, if opting for Direct Deposit, provide your routing number in item 10a, type of account in item 10b, and account number in item 10c.

- In item 11, provide detailed information that supports the claim, referencing any relevant documents.

- In item 12, enter the signature and title of the authorized person filling out the claim, ensuring their name is typed or legibly printed below the signature.

- Finally, in item 13, indicate the date the claim was signed. Once completed, save changes, download, print, or share the form as necessary.

Start completing your TTB F 5620 A - TTB form online today!

Multiply U.S. gallons by the percent of alcohol by volume. 2. Multiply by 2. 3....Sample calculation: 100 U.S. gallons x 40% alcohol by volume=4000. 4000 x 2=8000. 8000/100= 80 proof gallons.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.