Loading

Get 2013 I-002 Form X-nol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

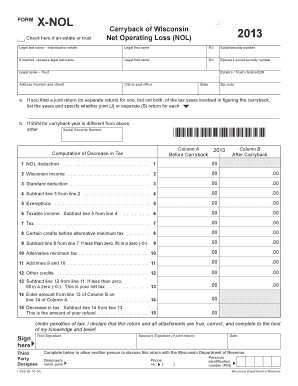

How to fill out the 2013 I-002 Form X-NOL online

This guide is designed to assist you in the process of filling out the 2013 I-002 Form X-NOL online. The instructions provided will help ensure that you complete each section accurately and efficiently.

Follow the steps to complete the form correctly

- Click ‘Get Form’ button to access the form and open it in your chosen editor.

- Begin by entering the legal last name, first name, and middle initial of the individual or estate at the top of the form.

- Provide the social security number associated with the individual or estate.

- If applicable, fill in your spouse’s legal last name, first name, middle initial, and social security number.

- Enter the legal name of the trust if relevant, and provide the estate or trust’s federal EIN.

- Complete your address, including the street number and name, city or post office, state, and zip code.

- If there is a carryback of a Wisconsin net operating loss, indicate whether you filed a joint or separate return for each tax year involved and note any different social security number for the carryback year.

- Fill in the grid for tax computations, starting with your Wisconsin income, standard deduction, and exemptions as directed.

- Complete the calculations for taxable income, tax, credits, and net tax as listed on the form.

- Affirm the accuracy of the information by signing the form. If filing jointly, ensure your spouse also signs.

- Finally, you can save your changes, download, print, or share the completed form as needed.

Begin filling out your documents online today to ensure deadlines are met efficiently.

Related links form

First, go back two years prior to the NOL year. ... If any portion of the NOL still remains after going back two years, subtract the remaining NOL from income in the first year prior to the NOL year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.