Loading

Get Form St - Sales

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST - Sales online

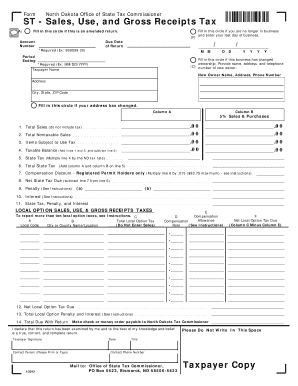

Filling out the Form ST - Sales is a crucial step for permit holders to report sales, use, and gross receipts taxes. This guide provides a clear and structured approach to completing the form online, ensuring that users can navigate the process with confidence.

Follow the steps to complete your Form ST - Sales online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Indicate if this is an amended return by filling in the appropriate circle. If you are no longer in business, mark the relevant circle and enter your last day of business.

- Enter your account number, ensuring it follows the required format (e.g., 999999 00). Specify the due date of the return along with the period ending.

- Provide your name, address, city, state, and ZIP code. If your address has changed, make sure to fill in that circle.

- Fill in the sales and purchases in columns A and B as instructed. Line 1 should include total sales (excluding tax), line 2 total nontaxable sales, and line 3 items subject to use tax.

- For line 4, calculate the taxable balance by adding lines 1 and 3 together and subtracting line 2. This amount should be accurate to avoid issues down the line.

- Multiply the amount from line 4 by the applicable tax rate to determine the state tax due, entering the result on line 5.

- Total state tax should be calculated on line 6 by adding values from both columns.

- For registered permit holders, calculate the compensation discount on line 7 if applicable. Enter the final amount due on line 8 after deducting any compensation.

- Complete line 11 by calculating the penalties and interest for late filings as specified in the instructions.

- Local option taxes should be reported accurately, with net local option tax due calculated on lines 12 and 13. Ensure all local option taxes are documented properly.

- Lastly, review the total due with the return on line 14, which combines previous lines to determine the final liability.

- Sign the return, print your name and title, and provide a contact number. Ensure the form is mailed to the correct address, using original forms only.

- Once completed, save changes, and you can download, print, or share the form as needed.

Complete your Form ST - Sales online today for a straightforward filing experience.

To request a tax refund, file an Application for Refund - Sales and Use Tax (Form DR-26S) or Application for Refund - All Other Taxes (Form DR-26). An application form may be completed to request moneys paid into the State Treasury for a tax overpayment, payment when tax was not due, or payment made in error.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.