Loading

Get Ftb 2518 Bc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 2518 Bc online

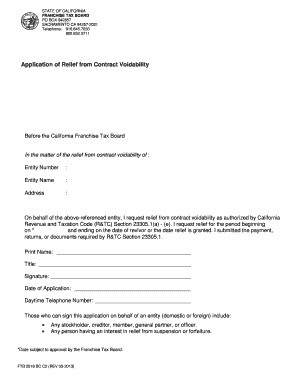

Filling out the Ftb 2518 Bc online is a straightforward process that allows users to request relief from contract voidability for an entity. This guide provides detailed, step-by-step instructions to help users complete the form accurately.

Follow the steps to fill out the form seamlessly.

- Click ‘Get Form’ button to obtain the Ftb 2518 Bc form and open it in the editor.

- In the section for 'Entity Number', enter the unique identifying number assigned to your entity. Ensure this number is accurate to avoid processing delays.

- Next, in the 'Entity Name' field, provide the official name of the entity for which you are requesting relief. Double-check for any spelling errors.

- Fill out the 'Address' field with the complete mailing address of the entity. This is important for communication regarding your application.

- Indicate the period for relief by entering the start date in the space provided. This period should align with the requirements set forth in California Revenue and Taxation Code Section 23305.1.

- Complete the 'Print Name' field with your full name. This should be the person submitting the application on behalf of the entity.

- In the 'Title' section, specify your official title or role within the entity. This establishes your authority to sign the application.

- Sign the application in the designated space. Make sure that the signature matches the name provided above.

- Enter the 'Date of Application', indicating when the form is being submitted. This date may be subject to approval.

- Provide a daytime telephone number where you can be reached. This allows the Franchise Tax Board to contact you if further information is needed.

- Once all fields are filled out correctly, you can save changes, download, print, or share the form as needed.

Complete your Ftb 2518 Bc form online today for efficient processing!

Filing a late tax return is one of the most common reasons that a large number of taxpayers owe money to the FTB. Specifically, a taxpayer can incur late fees on an unfiled return the day after not filing their tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.