Loading

Get Form Ct-245:2012:maintenance Fee And Activities Return For A ... - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-245:2012:Maintenance Fee And Activities Return For A Foreign Corporation online

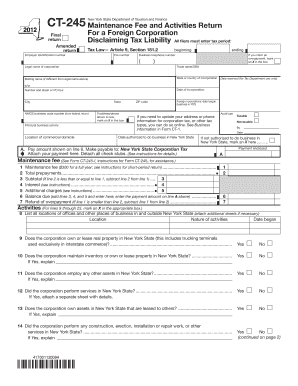

Filling out the Form CT-245:2012 is an important step for foreign corporations operating in New York State. This comprehensive guide will help you navigate the process of completing the maintenance fee and activities return online, ensuring that all necessary information is correctly submitted.

Follow the steps to accurately complete the Form CT-245:2012 online.

- Click the ‘Get Form’ button to access the form and open it in the editor for online completion.

- Enter the tax period for which you are filing at the top of the form. Ensure that you write both the beginning and ending dates clearly.

- Provide your employer identification number and file number, if applicable. This information helps accurately identify your corporation.

- Fill in the legal name of the corporation, trade name or DBA, and the mailing name if it differs from the legal name. Make sure to provide accurate details to avoid delays.

- Specify the state or country of incorporation and list the complete address including number and street, city, state, and ZIP code.

- Indicate your NAICS business code number and describe the principal business activity for your corporation.

- Complete the sections regarding taxable activities by answering the questions about property ownership, employment of assets, and service performance in New York State. Ensure you provide detailed explanations if you answer 'Yes' to any questions.

- List all employees engaged within New York State along with their respective duties and responsibilities. Attach additional sheets if necessary.

- Review all entries for accuracy. Upon completing the form, you can save your changes, download a copy for your records, print the form, or share it as required.

Complete and file your Form CT-245:2012 online today to ensure compliance with New York State regulations.

date of the return. No additional extension of time to file Form CT-3-S or CT-4-S will be granted beyond six months. Mail returns to: NYS Corporation Tax, Processing Unit, PO Box 1909, Albany NY 12201-1909.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.