Loading

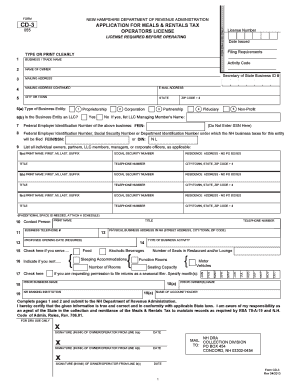

Get Form New Hampshire Department Of Revenue Administration Cd-3 For Dra Use Only Application For Meals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION CD-3 FOR DRA USE ONLY APPLICATION FOR MEALS online

Completing the Form New Hampshire Department of Revenue Administration CD-3 for DRA Use Only Application for Meals is essential for operators seeking the necessary license to provide meals and rentals. This guide will walk you through each section of the form, ensuring a smooth and complete application process.

Follow the steps to complete your application for meals online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, enter the business or trade name as it will appear on your license. This should be typed or printed clearly.

- Provide the legal name of the owner or the business entity, filling in the appropriate fields as required.

- Complete the mailing address section, including any additional address information if required.

- Include the e-mail address for communication regarding the Meals & Rentals Tax matters.

- List the city or town, state, and complete the zip code including any additional four-digit code.

- Indicate the type of business entity, such as proprietorship or corporation, by selecting from the options provided.

- If applicable, confirm if the business entity is an LLC by checking the corresponding box and providing the name of the managing member.

- Enter the Federal Employer Identification Number (FEIN) of the business, or state 'applied for' if you have not received it yet.

- Fill out the relevant Federal Employer Identification Number or Social Security Number under which the NH business taxes will be filed.

- List all individual owners, partners, LLC members, or corporate officers as required, ensuring to include their titles and contact information.

- Designate a contact person for licensing, including their name, title, and phone number if applicable.

- Provide the New Hampshire business telephone number.

- State the physical business address where the operations will occur.

- Input the proposed opening date of the business, which is mandatory to complete the application.

- Indicate the type of business activity the establishment will engage in, such as hotel, restaurant, or rental services.

- If your business serves food or provides accommodations, check the corresponding boxes and note the number of seats or rooms as applicable.

- State whether you will file as a seasonal operation, specifying the months the business will be active.

- If relevant, provide any former business name and previous owner's name in case of ownership change.

- List the banking institution details for where taxes collected will be deposited and account holder's name.

- Ensure all owners or operators listed sign the form in ink, certifying the information is accurate.

- Review the entire application for completeness and clarity before proceeding to submit.

- After completing the form, you can save your changes, download the document, print it, or share it as needed.

Complete your form online today to ensure your application for meals is processed smoothly.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.