Loading

Get Extension Of Time To File (dr 0021s) - Colorado.gov - Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Extension Of Time To File (DR 0021S) - Colorado.gov - Colorado online

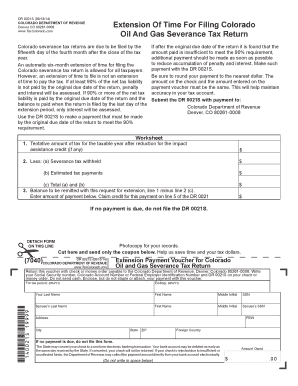

This guide provides detailed instructions on how to complete the Extension Of Time To File (DR 0021S) form for Colorado's oil and gas severance tax return. It is designed to assist users with various levels of experience in filling out this essential document accurately and efficiently.

Follow the steps to complete the form accurately.

- Click 'Get Form' button to obtain the form and open it for editing.

- Review the top of the form for the title and purpose. Ensure you fill out the details accurately to avoid delays.

- In the first section, provide the tentative amount of tax for the taxable year after accounting for any impact assistance credits. Enter this amount in the designated field.

- Calculate the balance to be remitted by subtracting the total deductions from the tentative amount of tax. Enter this final amount in the payment section, ensuring it is rounded to the nearest dollar.

- If no payment is due, note that you do not need to file the DR 0021S. Make sure to detach the payment voucher at the designated line if payment is due.

- Write your details accurately in the payment voucher section, including your last name, first name, and any necessary identification numbers. Ensure the amount entered matches your check or money order.

- Submit the completed form along with your payment to the address provided: Colorado Department of Revenue, Denver, CO 80261-0008. Avoid stapling your payment to the voucher.

- After submission, it is advisable to keep a photocopy of the completed form and any payment records for your own records.

Complete your Extension Of Time To File (DR 0021S) online for a smooth filing experience.

The Colorado Department of Revenue is currently not accepting Income Tax Returns on the Department's free Revenue Online website for the 2022 Tax Year. Coloradans will be able to use Revenue Online to file their state income taxes no later than February 22, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.