Loading

Get Cmvt

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cmvt online

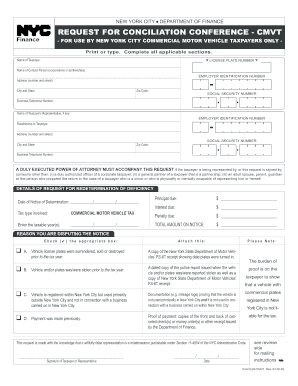

Navigating the Cmvt form can be straightforward with the right guidance. This guide provides step-by-step instructions to help you complete the Request for Conciliation Conference securely and accurately.

Follow the steps to fill out the Cmvt form online with ease.

- Click ‘Get Form’ button to access the Cmvt online and open it in the editor.

- Begin by filling in the 'Name of Taxpayer' field with the appropriate information. Ensure accuracy in spelling and format.

- In the section titled 'Name of Contact Person', enter the name of the individual responsible for this request if applicable. This typically applies to corporations or partnerships.

- Input your business address, including the street number and name, as well as city, state, and zip code.

- Provide your Employer Identification Number and/or Social Security Number in the specified fields.

- List your business telephone number to enable communication if necessary.

- If applicable, indicate the name of your representative and their relationship to you in the appropriate fields.

- Enter your license plate number and ensure to provide any employer identification and social security number as required.

- In the 'Details of Request for Redetermination of Deficiency' section, provide the date of notice, tax type involved, and applicable taxable years.

- Choose one or more reasons for disputing the notice by checking the respective boxes, based on your situation.

- Complete the financial information by entering the amounts due for principal, interest, penalty, and total amount on notice.

- Attach any necessary documentation as listed, such as proof of payment or police reports, meeting the requirements specified.

- Affix your signature where indicated and provide the date of signing to validate the request.

- Review all entries for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your Cmvt form online to ensure a smooth processing of your request.

The commercial motor vehicle tax is for the following vehicles: Non-passenger commercial motor vehicles used mostly in the city (i.e., 50% or more of the vehicle's annual mileage during the year is within the city) or mainly in connection with a business located in the city; and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.