Loading

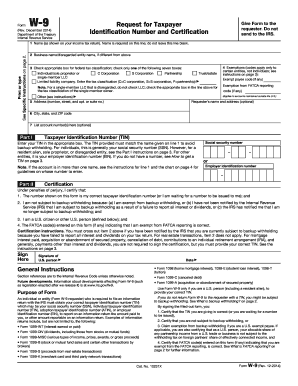

Get Form W-9 (rev. December 2014). Request For Taxpayer Identification Number And Certification - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-9 (Rev. December 2014). Request for Taxpayer Identification Number and Certification - IRS online

The Form W-9 is a crucial document required by the IRS for individuals and entities to provide their taxpayer identification number (TIN). This guide will assist you in accurately completing the form online, ensuring that you meet all necessary requirements and avoid any issues with backup withholding.

Follow the steps to complete the Form W-9 accurately.

- Press the ‘Get Form’ button to access the W-9 form and open it in your preferred document editor.

- Enter your name as it appears on your income tax return in line 1. This name is required and must not be left blank.

- If applicable, provide your business name or disregarded entity name in line 2.

- In line 3, check the appropriate box that represents your federal tax classification. Only one box may be checked. Options include C Corporation, S Corporation, Partnership, Trust/Estate, Individual/Sole Proprietor, and Limited Liability Company.

- If you qualify for any exemptions from backup withholding or FATCA reporting, provide the relevant codes in line 4.

- Complete your address in line 5, ensuring it includes your street number, street name, and apartment or suite number.

- Fill in your city, state, and ZIP code in line 6.

- If desired, you may list account numbers in line 7.

- In Part I, enter your TIN in the appropriate box. For individuals, this is typically your Social Security Number (SSN). Ensure that the TIN matches the name provided in line 1 to avoid backup withholding.

- In Part II, certify that the information provided is correct by signing the form and entering the date.

Complete your Form W-9 online and ensure your taxpayer information is accurately provided.

The companies are required to report the payments they made to your corporation to the IRS, and they need your accurate information as reflected on the W-9 to do so. The W-9 has an area for your signature, but the IRS does not require you to sign the form if your company is a corporation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.