Loading

Get 2015 Form 8752. Required Payment Or Refund Under Section 7519 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form 8752. Required Payment Or Refund Under Section 7519 - IRS online

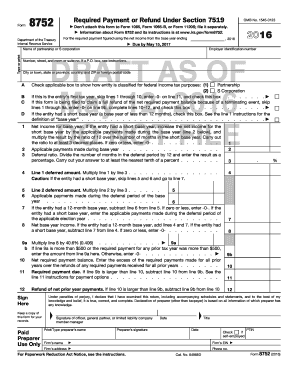

This guide provides clear and detailed instructions for completing the 2015 Form 8752, designed for partnerships and S corporations. Follow the steps below to ensure accurate filing and compliance with IRS regulations.

Follow the steps to effectively complete your Form 8752

- Click the ‘Get Form’ button to download and open the form for editing.

- Begin by providing the name of the partnership or S corporation at the top of the form.

- Enter the Employer Identification Number (EIN) in the designated field.

- Fill in the address of the partnership or S corporation, including street address, city, state, and ZIP code.

- Check the applicable box to indicate the entity's federal tax classification, either as a partnership or S corporation.

- If this is the entity’s first tax year, skip lines 1 through 10 and enter -0- on line 11, while checking the corresponding box.

- For the net income for the base year, refer to the previous year's Form 1065 or Form 1120S. Make necessary calculations if the base year was under 12 months.

- Document applicable payments made during the base year on line 2.

- Calculate the deferral ratio on line 3 by dividing the deferral period by 12, then multiply to find the deferred amount on line 4.

- Complete lines 5 through 12 where required, ensuring you carefully follow instructions for scenarios involving short base years or terminating events.

- Review all entries for accuracy before finalizing the form.

- Once completed, you can save changes, download, print, or share the form as necessary.

Complete your Form 8752 online today to ensure compliance and avoid penalties.

Your specific tax situation will determine which payment options are available to you. Payment options include full payment, short-term payment plan (paying in 180 days or less) or a long-term payment plan (installment agreement) (paying monthly).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.