Loading

Get Affected Members Must Submit This Form With Their Maine Income Tax Return - Maine

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Affected Members Must Submit This Form With Their Maine Income Tax Return - Maine online

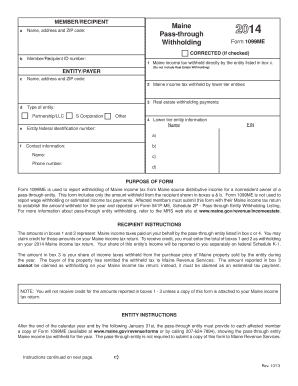

This guide provides clear and detailed instructions for filling out the 'Affected Members Must Submit This Form With Their Maine Income Tax Return - Maine' online. It is designed to assist users in accurately completing the necessary components of the form to ensure proper reporting of Maine income tax withholding.

Follow the steps to complete your Maine Income Tax Form accurately

- Click ‘Get Form’ button to access the form and open it in your editing tool.

- Enter your name, address, and ZIP code in the designated fields at the top of the form. This information is crucial as it identifies you as the recipient.

- Fill in your Member/Recipient ID number. This number is specific to you and should be provided by the pass-through entity.

- In Box 1, enter the amount of Maine income tax withheld directly by the entity listed in Box c. Ensure this amount reflects the correct withholding for the calendar year.

- For Box 2, if applicable, input the amount of Maine income tax withheld by any lower tier entities. This should include only amounts directly related to your income from those entities.

- If there were real estate withholding payments, document this in Box 3. This amount reflects taxes withheld from the sale of Maine property by the entity on your behalf.

- Complete Box d, by checking the appropriate type of entity from the options provided (Partnership/LLC, S Corporation, or Other).

- In Box 4, input the names and EINs of any lower tier entities from which your entity received withholding tax.

- Provide contact information including your name and phone number in the specified fields to allow for any necessary follow-up.

- Once all fields are filled in correctly, review the form for accuracy. You can then save changes, download, print, or share the completed form as needed.

Ensure you complete your tax documents accurately and submit them online for a smoother filing process.

Form 1310ME is used to claim an income tax refund on behalf of a taxpayer who has died. The form must be completed by the person who is claiming the refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.