Loading

Get State Of New Jersey Department Of The Treasury Division Of Taxation Schedule G-2 (r-2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATE OF NEW JERSEY DEPARTMENT OF THE TREASURY DIVISION OF TAXATION Schedule G-2 (R-2) online

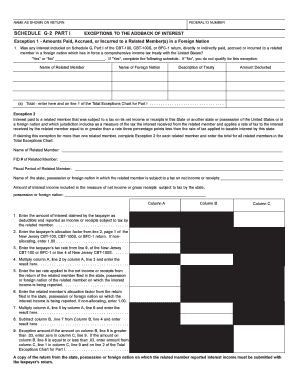

Filling out the Schedule G-2 (R-2) form is an essential step for taxpayers looking to claim exceptions for disallowed interest and intangible expenses. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form efficiently and accurately.

Follow the steps to successfully complete the Schedule G-2 (R-2) form.

- Press the ‘Get Form’ button to access the Schedule G-2 (R-2) form and open it in the editor.

- Begin by entering your name as shown on your return and your federal ID number at the top of the form.

- In Part I, identify the exceptions to the addback of interest. For each exception applicable, answer the 'Yes' or 'No' question accordingly.

- For Exception 1, provide the name of the related member and the foreign nation involved, along with the description of the treaty and the amount deducted.

- Repeat the process for Exception 2, ensuring you include all required details, including the related member's fid number and the fiscal period.

- Continue to Exceptions 3 and 4, ensuring all appropriate details are recorded. Remember to check the conditions for each exception carefully.

- In Part II, follow similar steps as in Part I for intangible expenses and costs, providing necessary details for each related member.

- Complete the Total Exceptions Chart by adding the amounts from each exception section for both Part I and Part II.

- Finally, review all entries for accuracy before proceeding to save your changes, download, or print the completed form for submission.

Take the first step towards completing your Schedule G-2 (R-2) form online today.

Retirement distributions from 401(k) plans or IRAs are considered income for tax purposes. Fortunately, there are some states that don't charge taxes on retirement income of any kind: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.