Loading

Get Note A Serviceperson Planning Early Release Should Give Both Present Military Address And Planned

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NOTE A Serviceperson Planning Early Release Should Give Both Present Military Address And Planned online

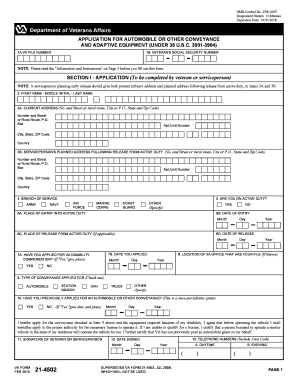

This guide aims to assist users in accurately completing the NOTE A Serviceperson Planning Early Release Should Give Both Present Military Address And Planned form. By following the step-by-step instructions, you will ensure all necessary information is provided clearly and effectively.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to access the form and open it in your chosen document editor.

- Provide your first name, middle initial, and last name in the designated fields.

- Enter your current military address in Item 3A, ensuring accuracy in the street address, city, state, and zip code.

- In Item 3B, enter your planned address following release from active duty, following the same format as in Item 3A.

- Indicate your branch of service by selecting from options such as Army, Navy, Air Force, Marine Corps, Coast Guard, or Other.

- Respond to whether you are currently on active duty in the relevant section.

- Fill out the place of entry into active duty, date of entry, place of release from active duty (if applicable), and the date of release.

- Provide the location of the VA office that holds your files, if known.

- Answer whether you have applied for VA disability compensation, including the date and place of the application if applicable.

- Select the type of conveyance you are applying for by checking the appropriate box.

- If you have previously applied for an automobile or other conveyance, respond accordingly and provide the pertinent date and place.

- Sign and date the application in the designated fields to attest the authenticity of the information provided.

- After completing all the necessary sections, save the changes, download, print, or share the form as needed.

Complete your document online to ensure a smooth submission process.

Yes, your SGLI is eligible as a permanent plan to borrow money against. To be eligible, your policy must be active for a year, or you must surrender the policy for its cash value. You can borrow up to 94% of your policy's cash value, after subtracting existing debt against your policy plus interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.