Loading

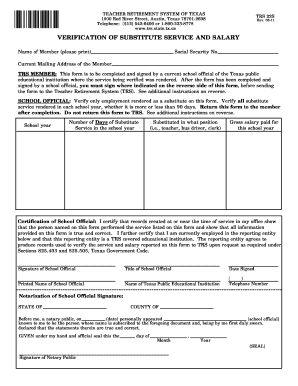

Get Verification Of Substitute Service And Salarytrs Form 22s. Verification Of Substitute Service And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Substitute Service And SalaryTRS Form 22S online

Filling out the Verification Of Substitute Service And SalaryTRS Form 22S is an important step for users seeking to verify substitute service for retirement credit. This guide will provide you with a clear, step-by-step approach to accurately completing the form online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the 'Name of Member' field, ensuring it is printed clearly.

- Fill in your Social Security number in the designated area.

- Provide your current mailing address in the 'Current Mailing Address of the Member' section.

- Have a current school official from the Texas public educational institution verify the service. This official should complete the relevant sections of the form.

- In the section labeled 'Number of Days of Substitute Service', input the total number of days you served as a substitute.

- Indicate the position you substituted for in the 'Substituted in what position' section.

- Record the gross salary paid for the substitute service in the appropriate field.

- Fill in the school year during which the service was rendered.

- The school official must sign and date the certification section, acknowledging the accuracy of the provided information.

- Ensure the school official’s title, printed name, and institution's name are also completed correctly.

- The school official must provide their contact telephone number.

- If required, ensure notarization of the school official's signature is completed.

- Sign the form where indicated as the member before submission.

- After completing the form, you can save changes, download, print, or share it as needed.

Complete your Verification Of Substitute Service And SalaryTRS Form 22S online today to ensure your substitute service is verified!

When substitute teachers are employed by a school district, they are subject to income tax withholding and receive an annual W-2 form that reports their earnings. In addition, the employer must withhold and pay Social Security and Medicare taxes and submit unemployment taxes on the employee's wages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.