Loading

Get St-123 New York State Department Of Taxation And Finance New York State Sales And Use Tax Ida Agent

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-123 New York State Department Of Taxation And Finance New York State Sales And Use Tax IDA Agent online

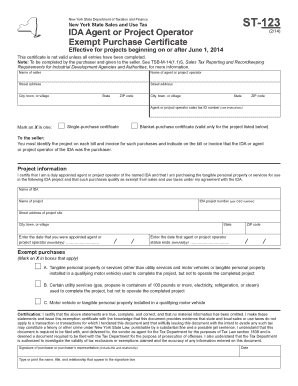

Filling out the ST-123 form is a crucial step for agents or project operators looking to claim sales tax exemptions for purchases related to industrial development agency projects in New York State. This guide will walk you through the online process of accurately completing the form to ensure compliance and efficiency.

Follow the steps to fill out the ST-123 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter the name of the seller in the designated field. Make sure to provide the full legal name of the individual or entity providing the goods or services.

- Fill in the name of the agent or project operator. This is the person designated to act on behalf of the IDA.

- Complete the street address, city, state, and ZIP code for both the seller and the agent or project operator. Ensure all addresses are accurate to avoid delays.

- Input the agent or project operator sales tax ID number. If not registered, mark 'N/A'.

- Select the type of purchase certificate by marking an X in the relevant box — either 'Single-purchase certificate' or 'Blanket-purchase certificate'.

- Provide the name of the IDA and the project associated with the exemption in the respective fields.

- Enter the IDA project number and the street address of the project site, including the city, state, and ZIP code.

- Indicate the date you were appointed as the agent or project operator and the date your status ends, using the mm/dd/yy format.

- Mark the applicable boxes for the exempt purchases, indicating the type of tangible personal property or services you are claiming exemption for.

- In the certification section, read the statements, and ensure you understand the legal implications. Sign and print your name, title, and relationship in the required fields.

- Once you have completed all entries, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your ST-123 form online today to ensure a smooth process for claiming your tax exemptions.

The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.