Loading

Get Pa 4r Printable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa 4r Printable Form online

Filling out the Pa 4r Printable Form accurately is essential for ensuring compliance with tax obligations. This guide provides clear, step-by-step instructions on how to complete the form online, making the process straightforward and user-friendly.

Follow the steps to complete the Pa 4r Printable Form online.

- Press the 'Get Form' button to obtain the Pa 4r Printable Form and open it in your preferred editor.

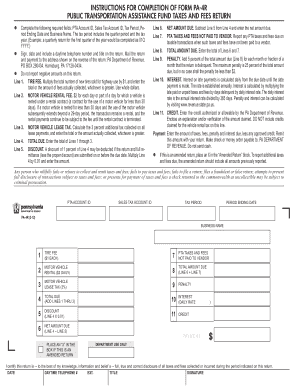

- Begin by entering your PTA Account ID, Sales Tax Account ID, Tax Period, Period Ending Date, and Business Name in the designated fields. Make sure the Tax Period is formatted correctly (e.g., '01Q YYYY' for the first quarter).

- Fill in Line 1 for the Tire Fee. Multiply the total number of new tires sold for highway use by $1, or enter the total amount of fees collected, whichever is greater.

- Complete Line 2 for the Motor Vehicle Rental Fee. Calculate $2 for each day or part of a day a vehicle is rented under a rental contract. Ensure to consider the rental period correctly.

- For Line 3, enter the total amount for the Motor Vehicle Lease Tax by calculating the 3 percent additional tax on all lease payments collected.

- In Line 4, add together the amounts from Lines 1, 2, and 3 to find the Total Due.

- Line 5 allows for a Discount. If submitting on or before the due date, calculate 1 percent of Line 4 and enter this amount as the discount.

- Calculate the Net Amount Due in Line 6 by subtracting the discount from Line 4.

- Use Line 7 to report any PTA taxes and fees that have not been paid to a vendor.

- In Line 8, sum Lines 6 and 7 to determine the Total Amount Due.

- Calculate and enter any Penalty in Line 9 for late submissions based on the total amount due.

- For Line 10, calculate any Interest on late payments at the established daily rate.

- If applicable, enter any authorized Credit in Line 11, accompanied by supporting documents.

- Fill in the Payment amount, including applicable taxes, fees, penalties, and interest less any credits.

- If this is an Amended Return, place an 'X' in the designated block.

- Sign and date the form. Include your daytime telephone number and title. Then, print the form for submission.

- Finally, save your changes, download or print the completed form, and follow the mailing instructions provided.

Start completing the Pa 4r Printable Form online today for a hassle-free filing experience.

Cancellation of Debt Incurred as Student Loans Generally, such loan payments or cancellation are not subject to Pennsylvania personal income tax unless the student provides services directly to the payor or lender in exchange for the cancellation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.