Loading

Get Tax $ - Ttb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax $ - Ttb online

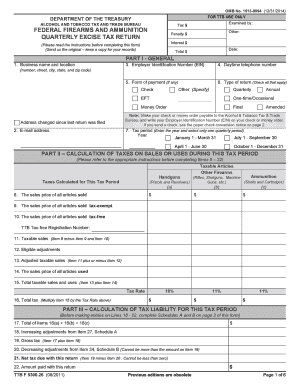

This guide provides clear, step-by-step instructions on how to accurately fill out the Tax $ - Ttb form online. By following these instructions, users can ensure a smooth filing process while complying with federal regulations.

Follow the steps to complete the Tax $ - Ttb form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- In the general section, enter your business name and location, including the number, street, city, state, and zip code.

- Provide your Employer Identification Number (EIN) in the appropriate field. If necessary, you may use your Social Security Number (SSN) only when filing a one-time or occasional return.

- Fill in your email address and daytime telephone number for communication purposes.

- Select the form of payment you intend to use from the options provided. Note whether you are making a one-time or occasional return.

- Indicate the type of return by checking all applicable boxes: Quarterly, Annual, Final, or Amended.

- In the tax period section, enter the year and select the corresponding quarterly period you are filing for.

- Proceed to Part II, where you will calculate taxes on sales or uses during the specified tax period. Start by entering the sales price of all articles sold in the relevant section.

- Fill out any applicable adjustments in Items 9 and 10, indicating tax-exempt and tax-free sales.

- Follow through with the calculations in Parts II and III, ensuring each item is correctly entered. Include totals as required.

- Complete the Certification section with your original signature and date it. Ensure all fields are filled out accurately.

- After reviewing your filled form for accuracy, save your changes, then download, print, or share the form as needed.

Complete your Tax $ - Ttb form online today to ensure compliance with federal regulations.

Beer is typically taxed at $18.00 per barrel (31 gallons), although a reduced rate of $3.50 per barrel applied to the first 60,000 barrels for breweries that produce less than two million barrels. Lower rates apply in both cases through end of 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.